Accounting is one of the backbone factors that shape the stable and sustainable development of a business. Of course, gone are the days when everything was done by hand. Businesses aim to choose a suitable accounting software so that their accounting staff can easily operate and carefully monitor the financial situation.

The most prominent accounting software applications are currently on the table, including Odoo Accounting vs QuickBooks. According to Odoo, up to now, they have 12 million users globally who have the opportunity to enjoy the special key features of Odoo Accounting.

Meanwhile, according to 6Sense's financial reporting, in 2024, globally there will be more than 103,125 companies using QuickBooks. Its accounting market share was also recorded at 84.96%.

Between these two competitors, which solution is better and more suitable for your business? Dive deep into our article to answer this question carefully!

Overview about Odoo Accounting vs QuickBooks

Understanding general information about Odoo Accounting vs QuickBooks is necessary before entering into a comprehensive comparison. You need to know the special features of each type to become a player who firmly understands the game policies, thereby easily making a choice with a key factor.

Odoo Accounting

Odoo Accounting is a core feature of Odoo - a comprehensive open-source solution for businesses. This module provides an extremely powerful and flexible accounting solution to manage financial and accounting activities easily, automatically and transparently.

At the same time, it also promotes the business activities of diverse businesses because it can easily operate in all 3 versions: Community, Enterprise and Online.

Main key features of Odoo accounting

- Multi-currency support

- Spreadsheet integration

- Automate invoice and payment processing with the help of AI

- Flexibility in bank statement format (Coda and Camt.053)

- Many financial consolidation options

- Language diversity

- Easy users' management

- Automation of the transfer and payment process (like with SEPA or ACH)

- Support of different tax calculation methods for each invoice line

Based on actual use and customer reviews, our team of experts with many years of experience in operating Odoo accounting has drawn out the pros and cons of Odoo accounting.

Pros

- Successfully support accounting operations in over 80 countries

- Able to communicate in about 85 languages

- Customize validation steps, streamlining workflow customizations

- Easily integrate spreadsheets for advanced data processing

- Automate recurring transaction processes

- The user interface is intuitive and clean, enhancing usability

- Fast and flexible search function for quick data retrieval

- Efficiently manage the transfer payment process (e.g. via SEPA or ACH)

- Fast and flexible search function for easy and quick data retrieval

- Comprehensive, easily customizable reporting capabilities

Cons

- Customer service in some regions is sometimes slow to respond

- Lack of detailed explanation in some error messages

- It can take time to train internal teams to use Odoo features well

QuickBooks

QuickBooks is an accounting software solution designed by Intuit, primarily for small and medium-sized businesses. With both Enterprise and Online versions, QuickBooks provides comprehensive financial management tools and features, designed to optimize accounting processes and improve business efficiency.

Main key features of QuickBooks

- Trade in many different currencies, facilitating international business operations

- Manage multiple users and accounting data effectively at the same time

- Use AI tools to import data from OCR invoices

- Integrated payroll processing

- Allows for detailed and customized invoices according to the needs of each different customer

- Easily export accounting reports to Excel

- The pros and cons of QuickBooks were also gathered after a thorough review of customer reviews, as well as our direct experience.

Pros

- Simplify the process of adding vendors and customers

- Create accounting reports easily and flexibly

- Reliable and long uptime, with timely warnings about any downtime

- Provides comprehensive tools and features to create and manage customer invoices

Cons

- The expense reporting and validation features are not too in-depth

- Does not support SEPA transfer or European bank statement formats

- High monthly costs. You also need to supplement costs with advanced features like inventory management or real-time tracking of accounting tasks.

Odoo Accounting vs QuickBooks: A Panoramic Comparative Picture

Criteria | Odoo Accounting | QuickBooks | Winner |

Pricing Plans | Flexible pricing plans, including free and paid version | Tiered pricing plans with various features | Odoo Accounting |

User Interface | User-friendly with customizable options | Simple and easy to navigate, more limited in terms of customization | QuickBooks |

Integration Capabilities | Ideal with comprehensive integration with 3rd party applications | Link to many business applications, but does not include spreadsheet applications | Odoo Accounting |

Bank Reconciliation | Streamline bank reconciliations with features like automatic reconciliation or automatic import | Simplify reconciliation but lacks some import options | Odoo Accounting |

Taxes | Provide flexible tax tools and reporting, suitable for a variety of tax requirements | Track taxes and create necessary tax forms with simple functions | Odoo Accounting |

Online Payment | Support many different payment platforms, simplifying the transaction process | Multi-platform payments, support for setting up recurring invoices, automatically updating and tracking invoice statuses | QuickBooks |

Invoices | Easily create and adjust invoices, and integrate seamlessly with other functions in the system | Create and customize invoices easily | Odoo Accounting |

Payroll | Advanced payroll features, suitable for businesses of all sizes | Basic salary calculation function, suitable for small and medium businesses | Odoo Accounting |

Income and Expenses Management | Focus on managing income and expenses with a comprehensive and in-depth financial picture | Track income and expenses with automatic synchronization | Odoo Accounting |

Reports and Analytics | Advanced, customizable reports, dashboards, and analytics tools | Standard financial reports, created with ease | Odoo Accounting |

Comprehensive Comparison of Odoo Accounting vs QuickBooks with 10 Key Functionalities

Entering the game in the fierce business market, understanding the key elements in accounting will help you quickly achieve your goals. Choosing an accounting software with the right strengths will take your operations to a new level.

Our detailed comparison below will help you quickly understand which tool you should choose between Odoo Accounting vs QuickBooks.

Pricing Plans

Odoo Accounting

Odoo Accounting is a feature of Odoo modules. So, it's free as a standalone app. Of course, when you pay for the Odoo package, you have full access to all its features, including Odoo Accounting.

For more details, please refer to Odoo's prices updated by us until June 2024:

- One App Free: completely free, allowing an unlimited number of users to access the Odoo Accounting module. It is suitable for businesses that only need to add accounting functions, without needing other applications.

- Standard: $9.10 per user/month. With this plan, you get access to all Odoo applications, including Odoo Accounting, and can be stored online. It is best-suited for businesses that need a comprehensive set of tools along with advanced accounting features, with functions such as CRM, sales, and inventory management.

- Custom: $13.60 per user/month. Besides the entire Odoo feature set, which includes Odoo Accounting, the Custom plan offers more advanced functionalities such as Odoo Studio for developing custom applications and accessing external APIs. It gives you flexible hosting options on Odoo Online or Odoo.sh (Odoo's integrated platform).

In short, when it comes to Odoo Accounting costs, you have two main options. This depends on available resources and the unique needs of your business.

- Free if you just need to use Odoo Accounting independently.

- Pay (from $9.10 per user/month) if you want to enjoy Odoo Accounting and all the other great features of Odoo.

QuickBooks

With QuickBooks when comparing Odoo Accounting vs QuickBooks, you need to pay to use it no matter which pricing plan you choose. However, its pricing structure is extremely flexible, suitable for businesses of many sizes and with different needs. This is also the advantage that makes QuickBooks a popular choice for many small and medium businesses.

Details of QuickBooks' 5 fundamental pricing packages:

- Self-Employed: starting from $15 per month. This pricing plan is designed primarily for freelancers and independent contractors. Key features of this plan include income and expense tracking, mileage tracking, and invoice setup. If you want additional services like tax and CPA support, the cost is $35 per month.

- Simple Start: $30 per month. Simple Start includes basic accounting tools for single users such as closely tracking income and expenses, invoicing, and managing tax deductions. Small businesses are also suitable candidates to use this plan.

- Essentials: $55 per month. Essentials allows up to 3 users. It builds on the basic features of Simple Starts, while adding a number of other functionalities such as invoice management, tracking unpaid invoices, and tracking employee working time to serve customers. salary calculation.

- Plus: $86 per month. It is ideal for businesses that require more advanced functionality such as project management tools, inventory tracking, budgeting and checking, and job costing. Plus allows up to 5 users.

- Advanced: $200 per month. For large businesses with complex needs, Advanced is considered a reasonable choice. It supports up to 25 users and offers advanced features such as workflow automation, bulk invoicing, dedicated account teaming, or advanced business performance analytics.

In addition to the operational features associated with each pricing plan, QuickBooks also offers strong customer support on all plans, including video tutorials, email and phone support, or chat online. Users can choose a 30-day free trial version or get a 50% discount for the first 3 months.

However, some essential and advanced features of QuickBooks require certain additional costs to use. Therefore, you need to identify the features your business really needs to avoid unexpected costs.

Verdict

In terms of pricing between Odoo Accounting vs QuickBooks, Odoo Accounting emerged as the winner. It offers free options if you just need to use the accounting software on its own or can combine it with other features with fees starting at just $9.1 per month. Transparency from the beginning without any additional costs also affirms the trustworthiness of the business owner.

User Interface

Odoo Accounting

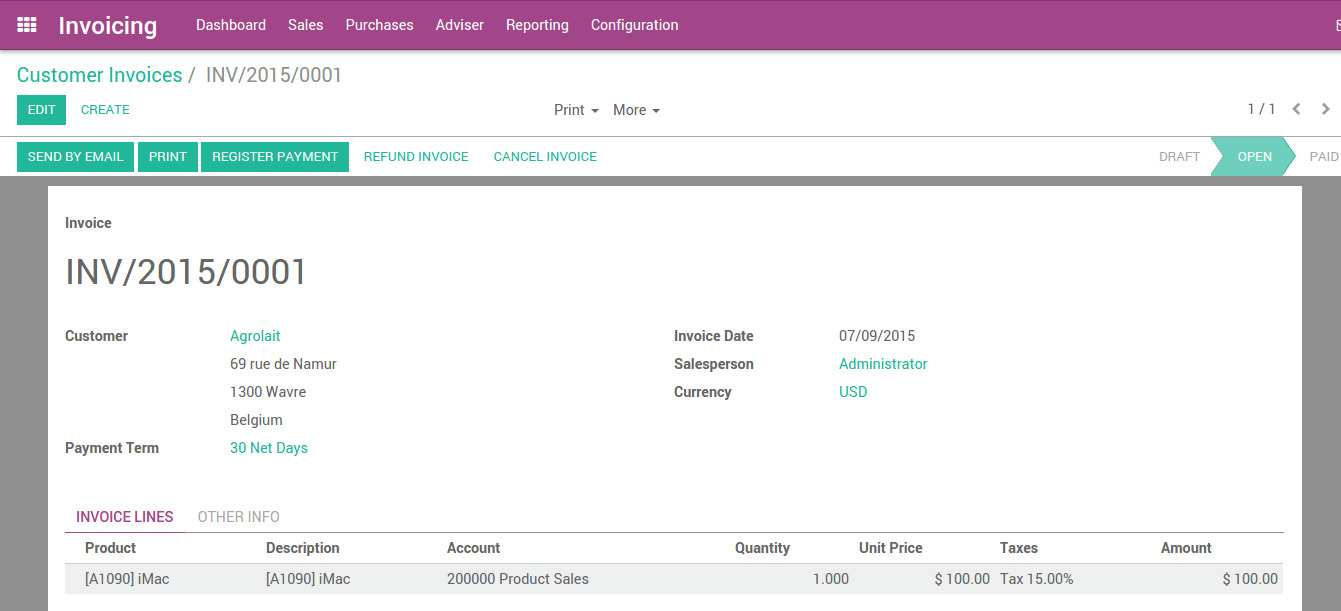

Odoo Accounting excels with its simplicity and user-friendly interface, allowing staff to effectively and easily manage tasks such as invoicing and account reconciliation. The simple layout makes navigation easy, even for users without a strong background in accounting. With an intuitive design, Odoo Accounting allows quick application of business operations without having to go through an in-depth training process.

However, you should also consider implementing Odoo Accounting's diverse customization options.

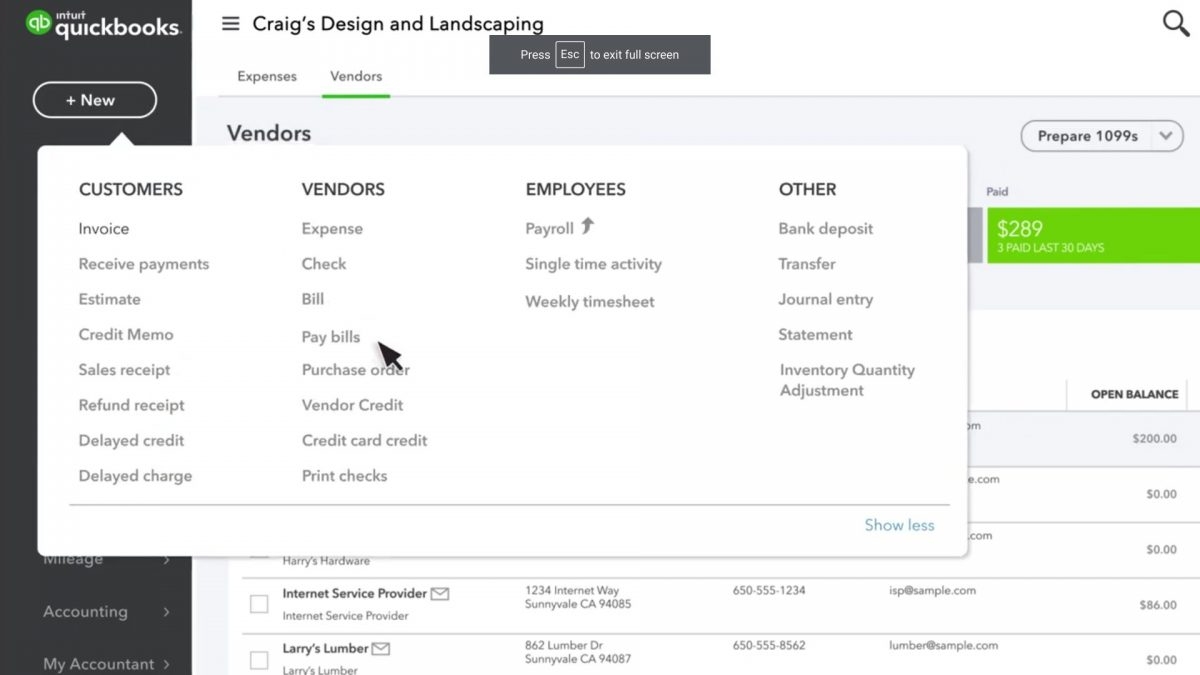

QuickBooks

QuickBooks, when compared to Odoo Accounting vs QuickBooks, provides a simpler and more user-friendly interface, helping them navigate intuitively and quickly perform business operations.

Possessing a rich feature set, QuickBooks offers a highly customizable interface that can be easily adjusted to meet the specific requirements of small and medium businesses effectively.

Verdict

When it comes to ease of use of Odoo Accounting vs QuickBooks, QuickBooks is the winner thanks to its adaptability and rich feature set. Users do not take too much time to get acquainted with the diverse set of tools available in QuickBooks, as well as easily train the staff below on how to use this software.

Integration Capabilities

Odoo Accounting

Odoo Accounting, between Odoo Accounting vs QuickBooks, excels in flexibility, providing natural and seamless integration. Originally, the Odoo toolkit includes many promising functions such as CRM, inventory or sales. Its large community and marketplace also offer many third-party plugins, and its flexible API thoroughly supports custom integration functionality.

In addition, Odoo Accounting also integrates smoothly with popular tools such as Paypal, Shopify, Stripe and spreadsheets applications, contributing to improving the utility of each different business process.

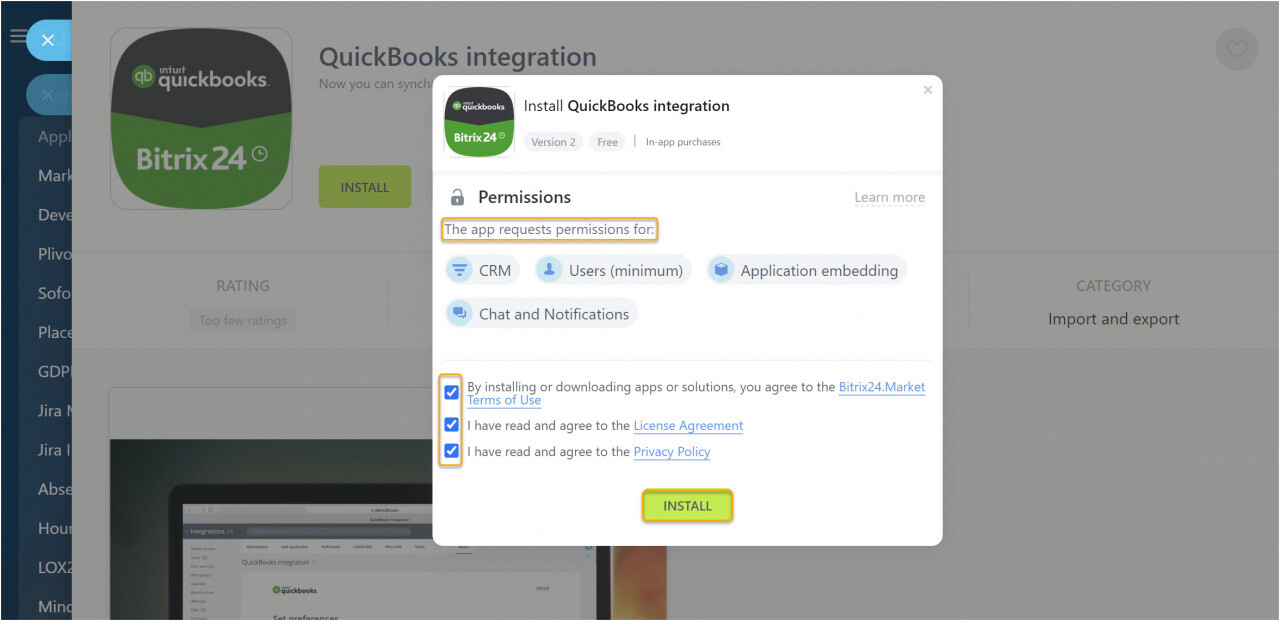

QuickBooks

QuickBooks impresses with its flexibility by integrating with hundreds of famous business applications, including payment platforms such as Square, Paypal or Stripe.

Essential tools like Method: CRM, Gusto or Amazon Business Purchases are also seamlessly integrated with this accounting software.

However, QuickBooks does not support direct integration with spreadsheet applications. This can be a limitation for businesses that rely heavily on spreadsheet tools to optimize data analysis and reporting processes.

Verdict

Odoo Accounting is the winner between Odoo Accounting vs QuickBooks when it comes to integration capabilities. It has comprehensive integration capabilities, including support for spreadsheet applications. With Odoo's open-source nature, combined with strong community support and extensive API capabilities, Odoo Accounting allows for deep integration and a diverse mix of features that businesses can use.

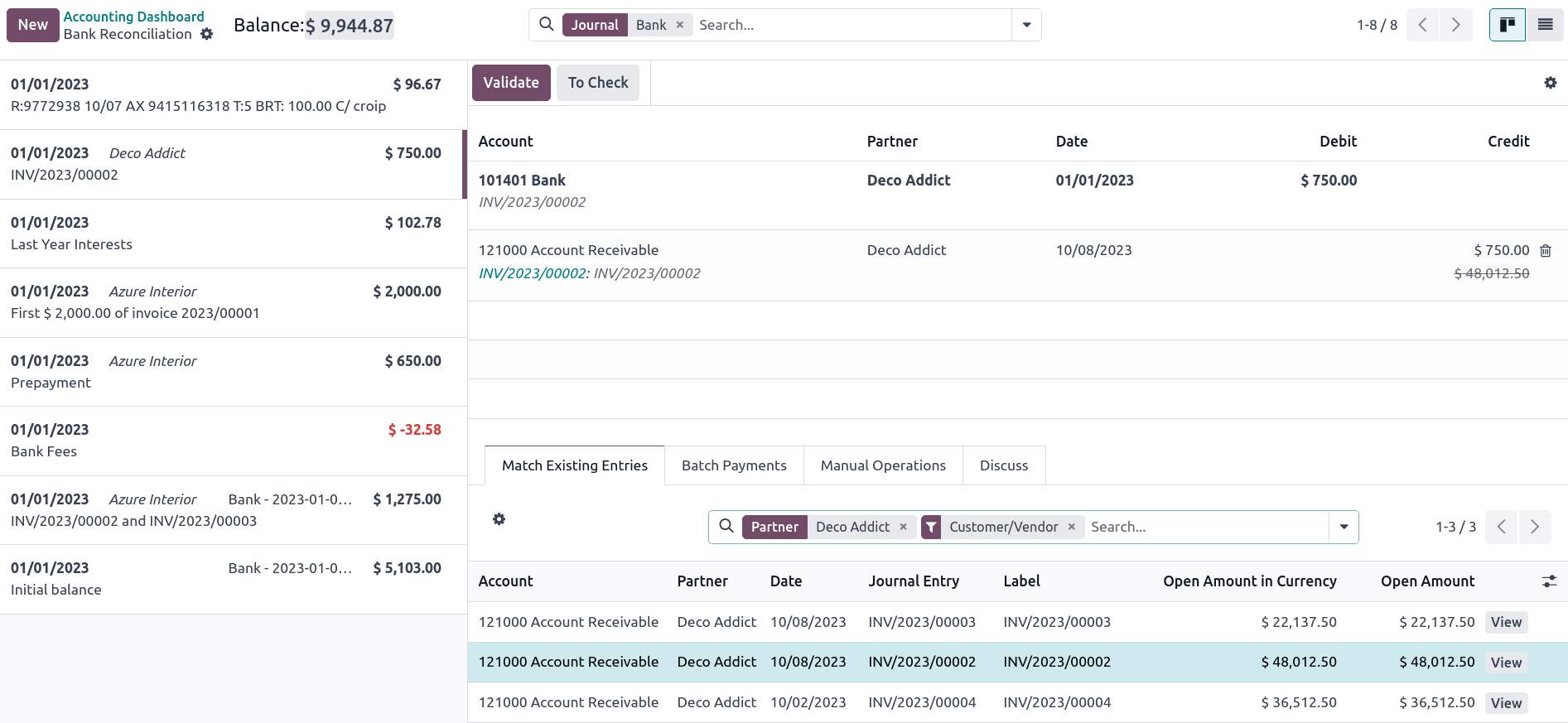

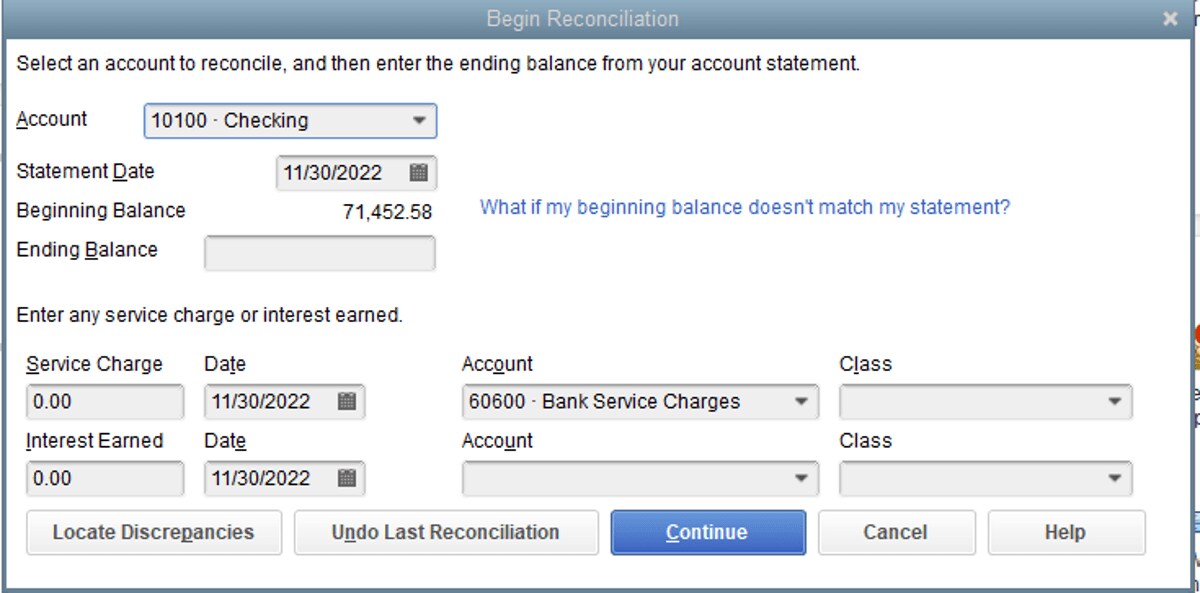

Bank Reconciliation

Odoo Accounting

Odoo Accounting provides a clear bank reconciliation process that seamlessly combines both manual and automated methods.

This feature of Odoo ERP has a purpose-built bank reconciliation module that allows users to automatically import bank statements, configure rules to match transactions, and track and process multiple bank accounts.

Odoo Accounting also supports complex transactions such as interbank transfers, meeting the needs of comprehensive financial management on a large scale.

QuickBooks

QuickBooks simplifies bank reconciliations by letting users proactively select transactions from bank statements and match them to different entries in accounting records.

This software demonstrates optimal capabilities when it can automate the reconciliation of transactions, as well as clearly mark differences for users to recognize and easily review as a whole.

One minus point of QuickBooks when compared between Odoo Accounting vs QuickBooks is that it cannot import bank statements in formats such as Coda or Camt.053.

Verdict

Clearly, Odoo continues to be the winner in this round when comparing Odoo Accounting vs QuickBooks. It gives users a comprehensive approach to bank reconciliation, from choosing a combination of manual and automatic, to advanced features such as supporting complex transactions and managing multiple banks at once.

Businesses that require extensive financial monitoring and reporting across multiple platforms can consider Odoo Accounting as an ideal choice.

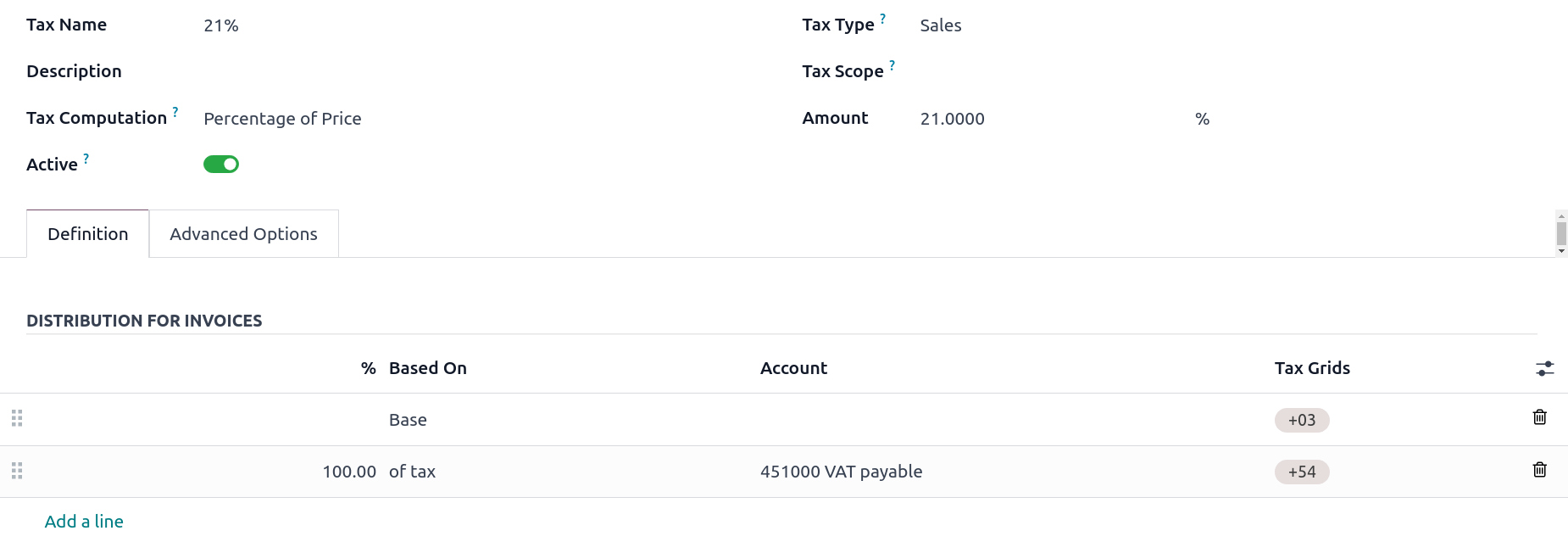

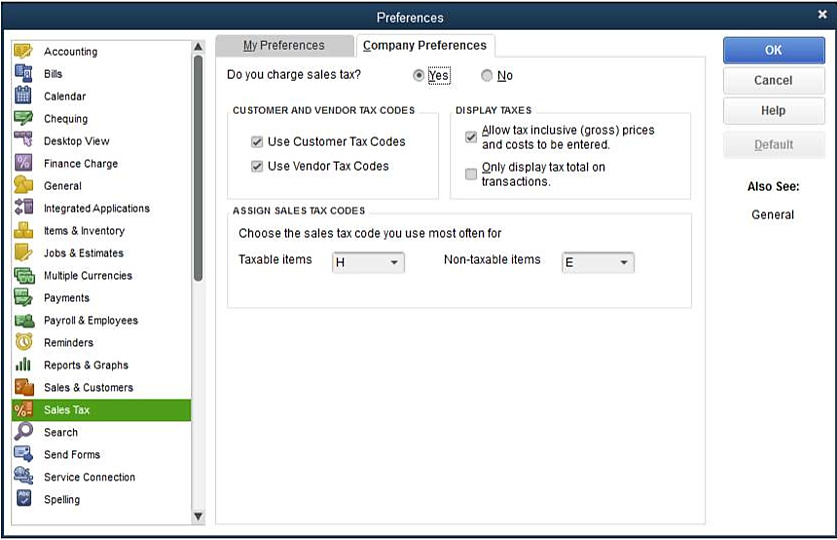

Taxes

Odoo Accounting

Odoo Accounting, between Odoo Accounting vs QuickBooks, excels in the tax management process with extremely flexible tools. It supports a variety of tax calculations, ensuring compliance with the most up-to-date tax regulations of each specific country.

Odoo Accounting also provides detailed tax reports, including tax audit reports or detailed information on tax calculations.

Thanks to that, users can be confident about the clarity and accuracy of their business's tax management process.

QuickBooks

QuickBooks offers powerful tax management features. It allows businesses to specifically track the sales tax process, easily create necessary tax forms such as W-2 or 1099 and receive specific notifications about items to prepare when tax season arrives.

It also offers a variety of tax-related reports to help businesses navigate their tax obligations smoothly.

However, a limitation of QuickBooks when compared to Odoo Accounting is that it does not provide many types of taxes per line and advanced tax-related services such as tax of taxes or fixed version.

Verdict

Odoo Accounting is a leader in tax management and adapting to tax-related changes with its comprehensive tax tools between Odoo Accounting vs QuickBooks. The ability to handle different types of tax calculations, detailed and country-specific tax reporting functions are Odoo's strong advantages, making it a superior choice for businesses aiming to manage taxes accurately and transparently.

Online Payment

Odoo Accounting

Odoo Accounting supports customers with online payments through famous transaction platforms, including Buckaroo, Stripe, PayPal, Adyen and Authorize.net.

Built-in integration with popular trading platforms allows businesses to easily manage transactions, track invoice status almost anytime, anywhere, set up recurring invoices and send payment reminders timely.

This ensures to speed up the payment process and build customer comfort when using the service.

QuickBooks

QuickBooks accepts online payments through a variety of methods, including debit cards, eChecks, and credit cards. Its popular payment gateways are Stripe, Paypal or Square, etc. It offers flexible payment options to customers.

QuickBooks also helps set up recurring invoices, automatically update and track invoice statuses effectively, as well as automated payment reminders. It helps improve the overall payment management efficiency of the business.

Verdict

QuickBooks wins when it comes to online payments between Odoo Accounting vs QuickBooks, thanks to its acceptance of many payment methods and strong integration with various payment gateways. Its flexibility optimizes the customer's payment management process, making QuickBooks a superior choice for processing online payments.

Invoices

Odoo Accounting

Odoo Accounting, compared between Odoo Accounting vs QuickBooks, excels at creating and processing invoices thanks to its seamless integration across many different business applications such as inventory management, CRM or project management.

This connectivity allows businesses to automate the creation of draft invoices from real-time updated customer orders, timesheets or delivery notes. This behavior minimizes delays and costs that come from manual efforts.

This system also supports detailed customization activities on invoices, including payment terms, discounts, and tax configurations based on customer needs.

The richness in functional allocation ensures that the invoices system fully meets specific business needs, and specific requirements related to brand image if necessary.

QuickBooks

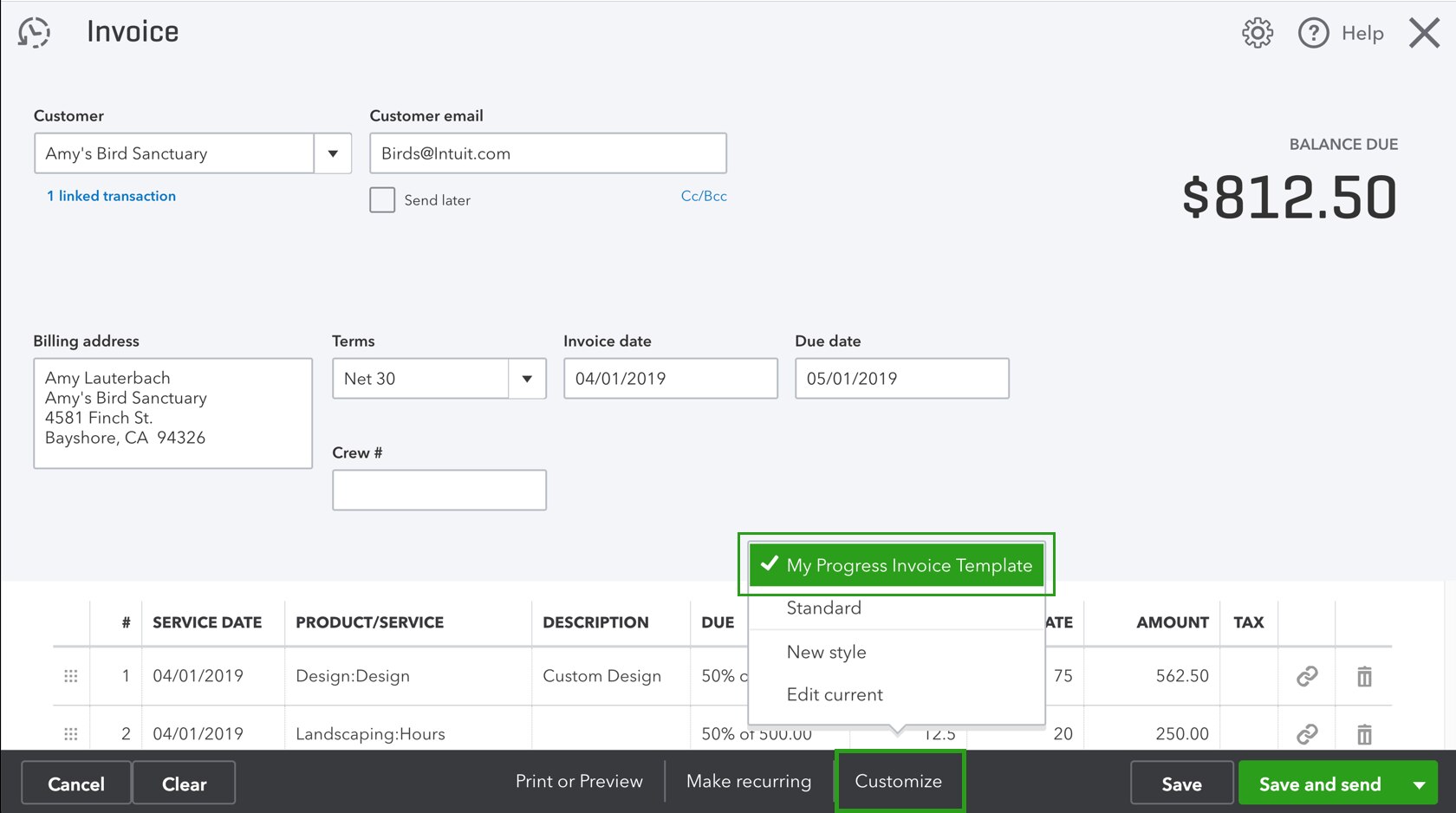

QuickBooks has a simple and user-friendly invoice creation process. This is also what many small and medium businesses are looking for.

Choosing to use QuickBooks, you will be provided with 6 customizable invoice templates. It allows businesses to not only perform required tasks, but also can easily edit aesthetically to match brand identity, even on each invoice, before reaching the customer.

Tasks to create recurring invoices are also confirmed to be timely and effective in financial management when using QuickBooks.

Verdict

Odoo Accounting stands out thanks to its comprehensive integration with various business modules and powerful automation in invoice creation between Odoo Accounting vs QuickBooks. Setting up and processing invoices for businesses, especially small and medium enterprises, will no longer be a problem.

Payroll

Odoo Accounting

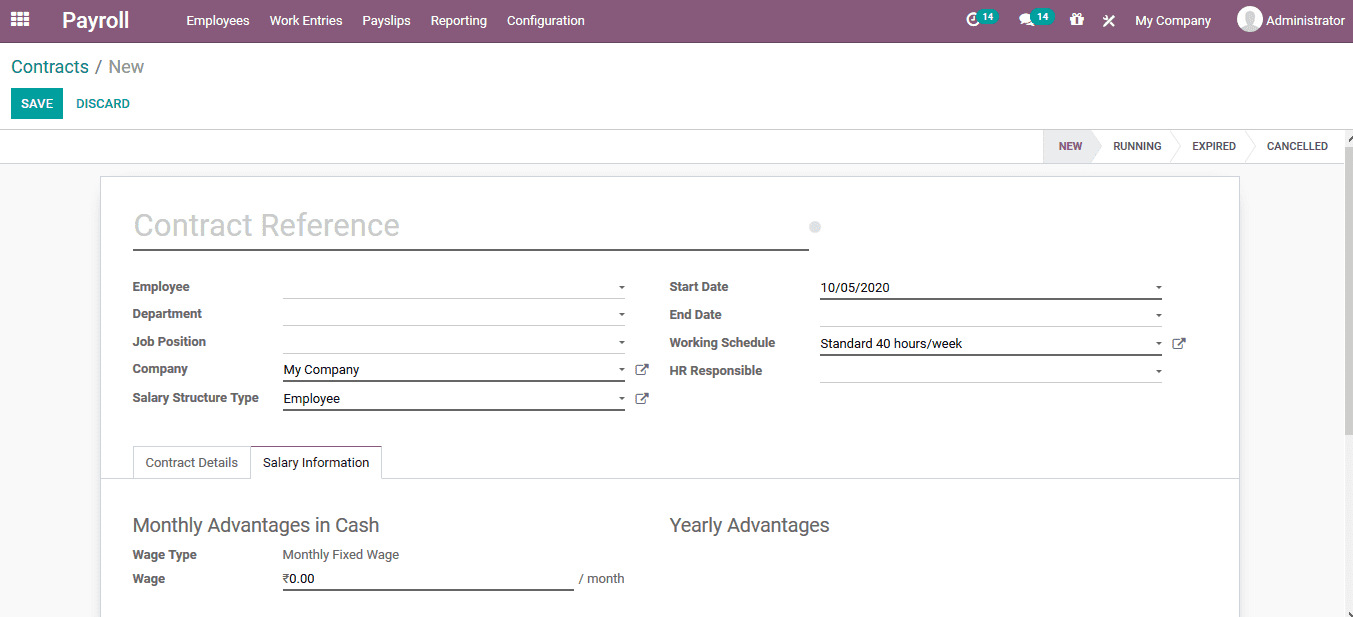

Odoo Accounting's Payroll module includes advanced features such as tracking attendance status, managing leave, or calculating employee salaries. It integrates seamlessly with other features in the Odoo system, including human resources and accounting.

This strong compatibility allows businesses to focus on managing all-in-one business functions, increasing convenience in payroll administration and minimizing operating costs thanks to automated processes.

QuickBooks

QuickBooks, between Odoo Accounting vs QuickBooks, provides basic payroll features, serving simple payroll and payroll needs such as calculating payroll, setting up basic tax filing templates, etc.

However, QuickBooks will not possess advanced payroll features such as items related to timekeeping. It doesn't integrate too deeply with the HR system.

This process can lead to additional manual work items, and challenges in accessing aggregated information. If your business is expansion-oriented with complex payroll-related requirements, it will be a big challenge.

Verdict

Odoo Accounting wins payroll features thanks to its advanced features and seamless integration with other business modules when comparing Odoo Accounting vs QuickBooks. If you are looking for a software that possesses comprehensive features and an effective approach throughout the entire payroll management cycle, Odoo Accounting will be a solution worth considering.

Income and Expenses Management

Odoo Accounting

Odoo Accounting possesses powerful management tools for you to control costs in the most general way.

A special point when it comes to Odoo Accounting is the ability to consolidate all bank accounts into one and only one view. This centralization allows you to effectively monitor invoices, specifically track cash flow status, expenses and more broadly report overall financial status.

Advanced features related to income and expenses also include predictions about likely financial situations in the near future based on current trends and the company's operating status.

You can partly anticipate situations that may arise and take measures as soon as possible to prevent bad situations from occurring for business development.

QuickBooks

QuickBooks seamlessly syncs credit cards and banking for your business, simplifying income and expense management. In particular, when customers pay via QuickBooks Payments, every money transfer journey is automatically recorded immediately.

QuickBooks also performs cost analysis, suggests classifications, associates' costs with specific projects or customers, or divides costs as needed by the user. You can also use receipt images to easily store and record the cash flow journey.

Verdict

Odoo Accounting is a winner with its comprehensive all-in-one solution approach when comparing Odoo Accounting vs QuickBooks. By consolidating all financial accounts into a single view, it ensures businesses have a clear understanding and, crucially, an overview of the financial picture. From there, drawing conclusions becomes more intuitive and closer to reality than ever.

Reports and Analytics

Odoo Accounting

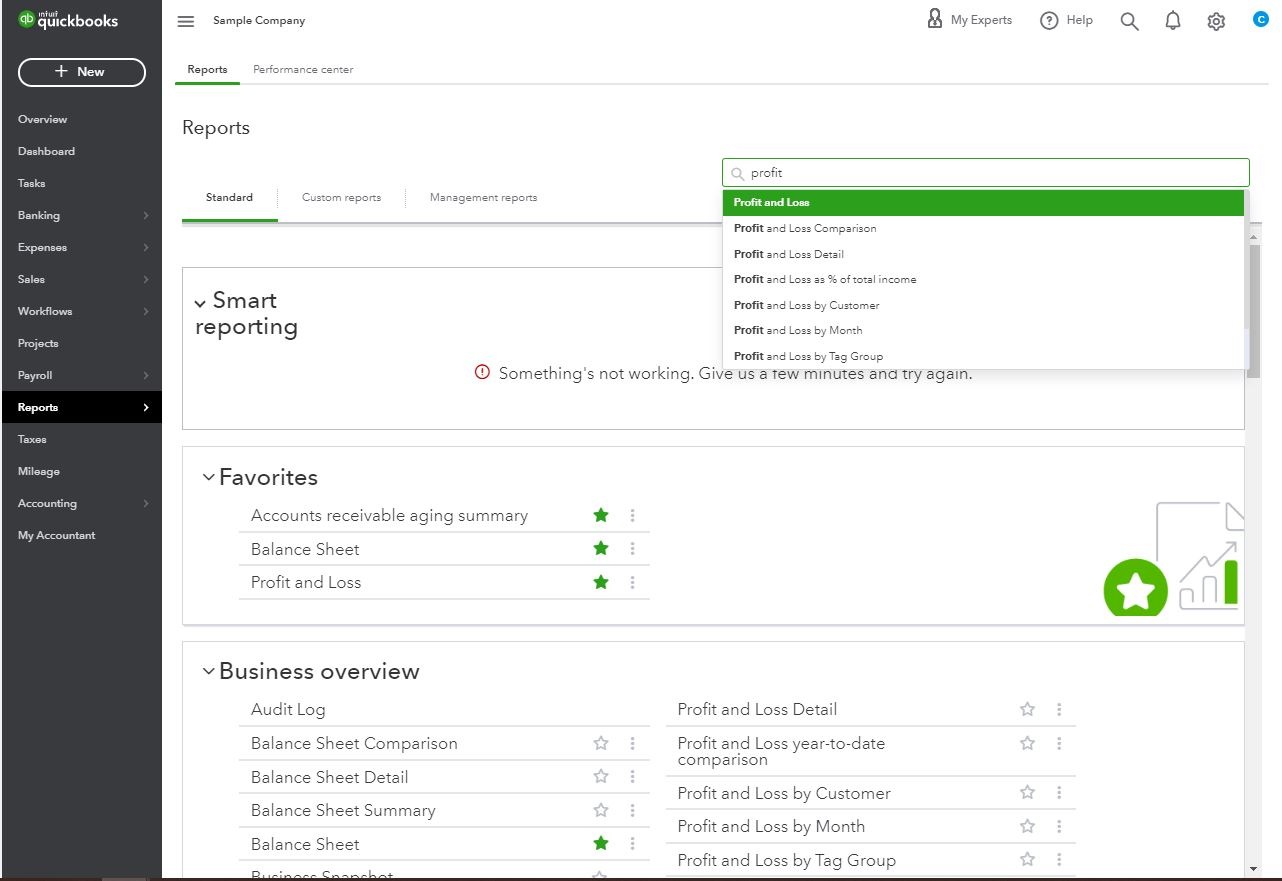

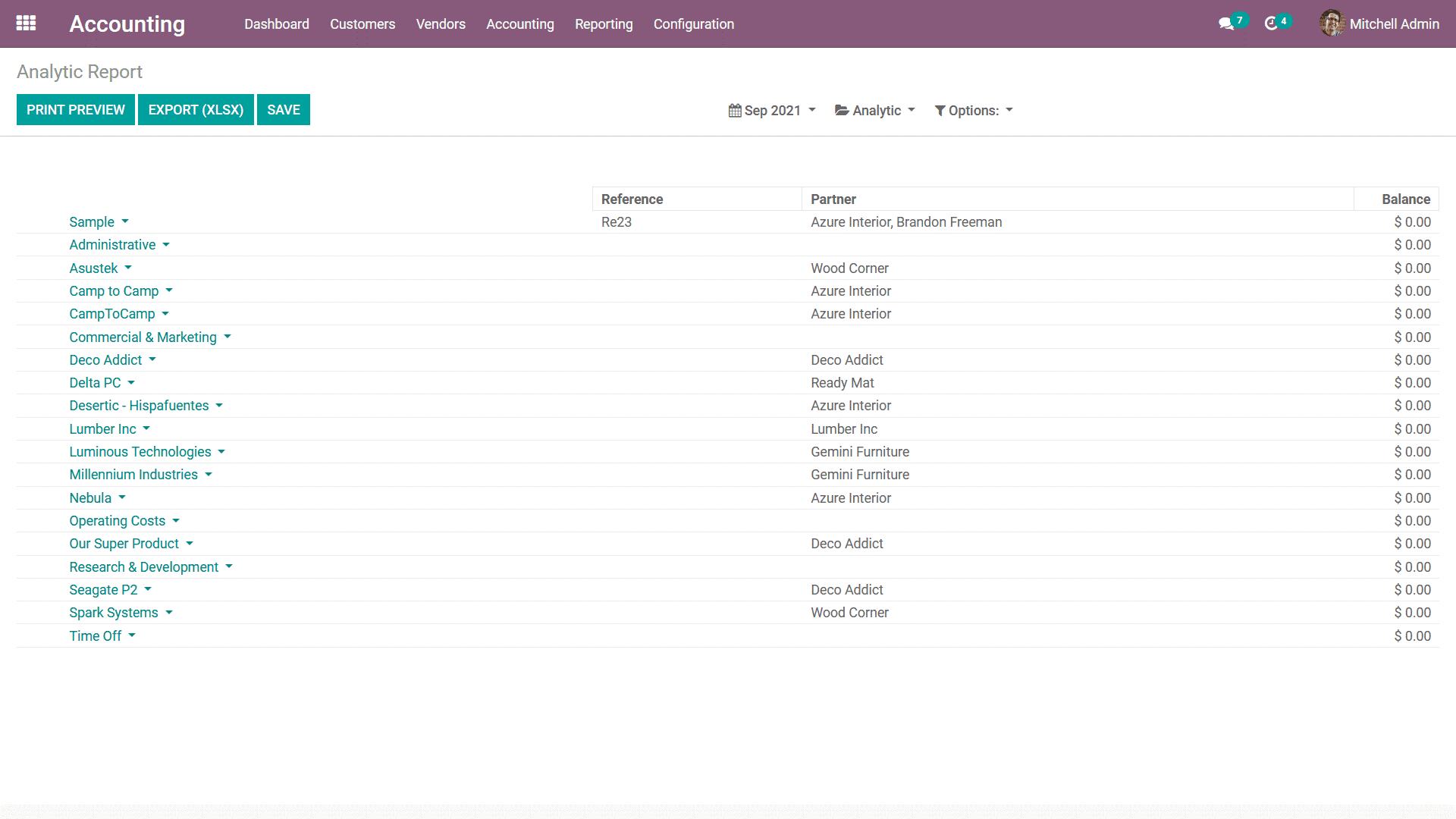

Odoo Accounting has the ability to create a summary of all functions across multiple dimensions, necessary financial reports, including balance sheets, and income statements. This functionality of Odoo module also allows users to customize reports, dashboards and key performance indicators (KPIs).

Some special additional functionalities including reporting annotations, managing fiscal year-end, defining executive summary content, etc., are also available when using Odoo Accounting.

QuickBooks

When using QuickBooks between Odoo Accounting vs QuickBooks, you have the opportunity to use many types of standard reports such as balance sheets, business profit and loss reports, or cash flow statements.

It possesses basic features to operate and set up multi-dimensional reports, however, QuickBooks does not possess advanced features like Odoo Accounting such as annotating reports or defining KPIs.

Verdict

There is no longer any doubt, Odoo Accounting is the winner thanks to its extensive customizations and advanced analytics features in creating and building thorough reports. Building and planning accounting activities is no longer a big challenge for businesses when using Odoo Accounting.

Odoo Accounting vs QuickBooks: Which Proves The Superior Choice?

After a detailed comparison drawn from directly using Odoo Accounting vs QuickBooks, as well as linking each function with insights from small and medium enterprise customers, we have a solid conclusion: Odoo Accounting is the superior choice with comprehensive features and cost-effectiveness. With Odoo Accounting, businesses have access to an integrated suite of applications beyond accounting, including CRM, project management, and inventory management.

Furthermore, Odoo's flexible pricing plans, including free and paid versions, offer many options when it comes to scalability and affordability. Strong integration of advanced features such as bank reconciliation or tax management also helps businesses always operate legally and feel secure if there is any inspection.

The financial activities of the business are also drawn into an overall picture, helping you make business decisions quickly, wisely and reasonably.

Final Thoughts

We have thoroughly answered the confusion between Odoo Accounting vs QuickBooks in the above article. With each function, each software will have distinct advantages. However, our expert experience has confirmed that at the present time, Odoo Accounting still has the upper hand.

Of course, there is still much to discuss about Odoo Accounting vs QuickBooks, especially how to operate and implement each aspect in practice. You still need a more in-depth experience, we believe, to really find out the key accounting problem your business is facing.

At this time, you can use the demo versions, or faster let us, A1 Consulting, give you a hand. As a trusted partner of Odoo, we have a team of high- skilled consultants with experience in effectively operating Odoo projects to give you the most accurate advice.

Get in touch with us right now for a better understanding about Odoo Accounting vs QuickBooks!