Malaysia has been entering a new era of financial and tax transparency with their e-invoicing mandate. Starting from 1 August 2024 and ending in July 2025 with 3 phases corresponding to 3 different groups of Malaysian businesses, the e-invoicing process has achieved initial significant results. This structured approach applies to a wide range of documents, from sales invoices to credit and refund notes.

In this context, self billed e invoice is considered a critical yet intricate requirement. It is generated by the buyer, not the supplier, and must pass a rigorous validation process to qualify as a recognized tax document. Its accuracy and compliance is unquestionable. However, not everyone has a specific and comprehensive understanding of this type of Malaysia e-invoice.

This article of ours will help you have an expert look at self billed e invoice in Malaysia, unraveling its purpose, intricacies, and impact on the evolving financial landscape.

Overview About Self Billed e Invoice: All You Need To Know

Definition: What is a self billed e invoice?

A self billed e invoice is an exceptional form of invoice issued by the buyer rather than the supplier. It arises in cases where the supplier, such as an unregistered seller or a foreign entity, is not yet able to provide e-invoices to the buyer in Malaysia. In these cases, the buyer will be responsible for creating the invoice to accurately record the transactions.

The self billed e invoice serves dual purposes:

- Serves as a record of expense for the buyer

- Meets all tax compliance requirements

Once the buyer submits his self billed e invoice to the Inland Revenue Board of Malaysia (IRBM) and receives validation, this e-invoice becomes an official document for financial and tax purposes. A certified copy must also be shared with the supplier, meeting the requirements for transparency of the transaction.

Detailed parties in a self billed e invoice

When implementing a self bill e invoice, understanding the roles of the involved parties is key. Each party has a distinct responsibility for completing the invoice accurately and smoothly. Our detailed table below outlines the specific parties involved in different self-billing scenarios:

Transaction type | Supplier | Buyer (assumes role of supplier to issue self billed e invoice) | Purpose |

e-Commerce transactions | Merchants, service providers (e.g., drivers, riders) | e-Commerce or intermediary platform | Facilitate invoicing for digital and online marketplace operations. |

Payment to agents, dealers, distributors | Agents, dealers, distributors | Taxpayer making the payment | Document intermediary payments with accurate e-invoices. |

Goods or services from foreign suppliers | Foreign seller | Malaysian purchaser | Enable cross-border transactions with compliant invoicing. |

Purchases from individual taxpayers | Individual taxpayers providing goods or services | Taxpayer acquiring goods or services | Handle transactions with individuals efficiently. |

Profit distribution (e.g., dividend payouts) | Recipient of the distribution | Taxpayer making the distribution | Record profit-sharing activities transparently. |

Interest payments | Recipients of interest payments | Taxpayer making the interest payment | Make sure of proper documentation of financial interest transactions. |

Pay-outs to betting and gaming winners | Recipients of the pay-out | Licensed betting and gaming provider | Maintain precise records for payouts in regulated industries. |

What you need to input to complete self billed e invoice?

Completing the self-billed e-invoice is a process that requires meticulous attention to detail, especially if the buyer does not have much experience with processing e-invoices. Each input field must align with IRBM’s specific guidelines for self billed e invoice. The information varies depending on whether the supplier is a business entity, an individual, or a foreign party.

Here’s a breakdown of the required data for self billed e invoice implementation:

For supplier’s information:

Accurate information about suppliers is always an important element in all e-invoices, and self billed e invoices are no exception.

Field | Details required | Notes |

Supplier name | Full official name of the supplier, whether an individual or a business. |

|

Taxpayer Identification Number (TIN) | TIN assigned to the supplier. | Malaysians may substitute MyKad/MyTentera number if TIN is not available. |

Registration or ID number | Business registration number for companies, or identification/passport number for individuals. | If unavailable, input "NA" for foreign suppliers. |

Address | Business location (for companies) or residential address (for individuals). | This must match official documentation. |

Contact number | Supplier’s official phone number for easy communication. | Crucial for follow-up or verification. |

SST registration number | Supplier’s Sales and Service Tax (SST) registration number, if applicable. | Use “NA” for non-registered suppliers. |

For buyer’s information:

If the transaction involves an individual buyer, detailed personal information is also required explicitly with specific information fields in the self-billed e-invoice.

Field | Details required | Notes |

Buyer name | Full legal name of the individual. |

|

Buyer TIN | Taxpayer Identification Number (if applicable). | Foreign buyers without TIN should include passport information. |

Phone number | Buyer’s contact number. | Important for verification purposes. |

Residential address | Full and accurate address of the buyer. | Required for record-keeping purposes. |

For transaction records’ details:

A self billed e invoice must include comprehensive transaction-specific details:

Field | Details required | Notes |

Business activity | A concise description of the supplier's services or products. | Example: "Retail of electronics" or "Freight forwarding services." |

Malaysia Standard Industrial Classification (MSIC) code | A 5-digit code that represents the supplier’s main business activity. | Refer to the Malaysian industrial classification framework. |

Classification code | A 3-digit code representing the product or service category. | This must adhere to e-invoicing standards. |

e-Invoice Reference Code | Internal reference number for tracking the invoice within your system. | Optional but recommended for smooth reconciliation. |

An example of completed self billed e invoice will bring to you a clearer view:

Field | Example input |

Supplier name | Brightline Logistics Co. |

Supplier TIN | 987654321012 |

Supplier address | 12 Jalan Perdagangan, KL, Malaysia |

Buyer name | Lee Jun Hao |

Buyer TIN | 123456789012 |

Transaction Description | Shipping and handling services |

Classification code | 205 |

Self billed e invoice exemptions

Self billed e invoices are an important part of Malaysia’s digital tax ecosystem. However, according to IRBM, some types of income or expenses fall outside the scope of this type of e-invoice.

- Employment income (salaries, wages, and benefits provided to employees, also including remuneration and allowances): is included in the payroll and tax filing system.

- Alimony (payments made for spousal or child support following legal agreements): is exempted under retirement regulations in Malaysia.

- Pension (retirement benefits received by former employees): is considered as personal support payments.

- Dividend distributions (earnings distributed to shareholders, including taxpayers ineligible for Section 108 tax deductions under ITA 1967 and publicly listed companies on Bursa Malaysia): is regulated under the finance and taxation laws in Malaysia.

- Zakat (contributions made for Islamic charitable obligations): is considered as religious and charitable obligations.

Complete Process of Self Billed e Invoice: Step-by-Step Guide

The process of generating a self billed e invoice Malaysia involves distinct steps, designed to maintain accuracy, compliance, and transparency.

Step 1: Submission of transaction details

The buyer begins the process of generating a self billed e invoice by carefully preparing the details and submitting them to the Inland Revenue Board of Malaysia (IRBM). This step of creating self-billed e invoice Malaysia requires careful and meticulous attention to detail on the part of the buyer.

Data compilation:

Collect all the required information as we noted above, including:

- Supplier and buyer details (e.g., name, address, tax identification number).

- Transaction details, such as invoice date, amount, and description of goods or services.

- Specific self billed e invoice indicators to distinguish it from standard invoices.

Submission options:

- MyInvois portal: Manually enter the transaction details into the portal form fields. You need to carefully verify the accuracy of the data before confirming the submission.

- E invoicing API transmission: Automatically transmit data through an integrated accounting system or ERP connected to IRBM's database.

One thing you need to pay close attention to is the time sensitivity when performing self billed e invoice creation activities.

- For imported goods: self-billed e invoice Malaysia must be submitted before the last day of the month after customs clearance.

- For imported services: self billed e invoice Malaysia must be submitted before the last day of the month after payment or receipt of supplier invoice, whichever comes first.

Step 2: Validation by IRBM

Once the transaction details are completed and submitted, IRBM will validate the information to ensure your self billed e invoice meets all compliance requirements. This check includes several steps:

- Verification of submission data: Verify the accuracy of the taxable amount, tax identification number, and invoice classifications. Cross-reference the buyer and supplier tax identification numbers with the IRBM registry.

- Approval process: Once all details are met, IRBM will generate two crucial components - QR code (embedded in e-invoices as a visual indication of authenticity), Unique Identification Number (UIN) (a unique reference number for easy tracking and tracing).

In case of any errors or omissions, the submission is rejected with an error code indicating the issue. Corrections must be made before resubmission.

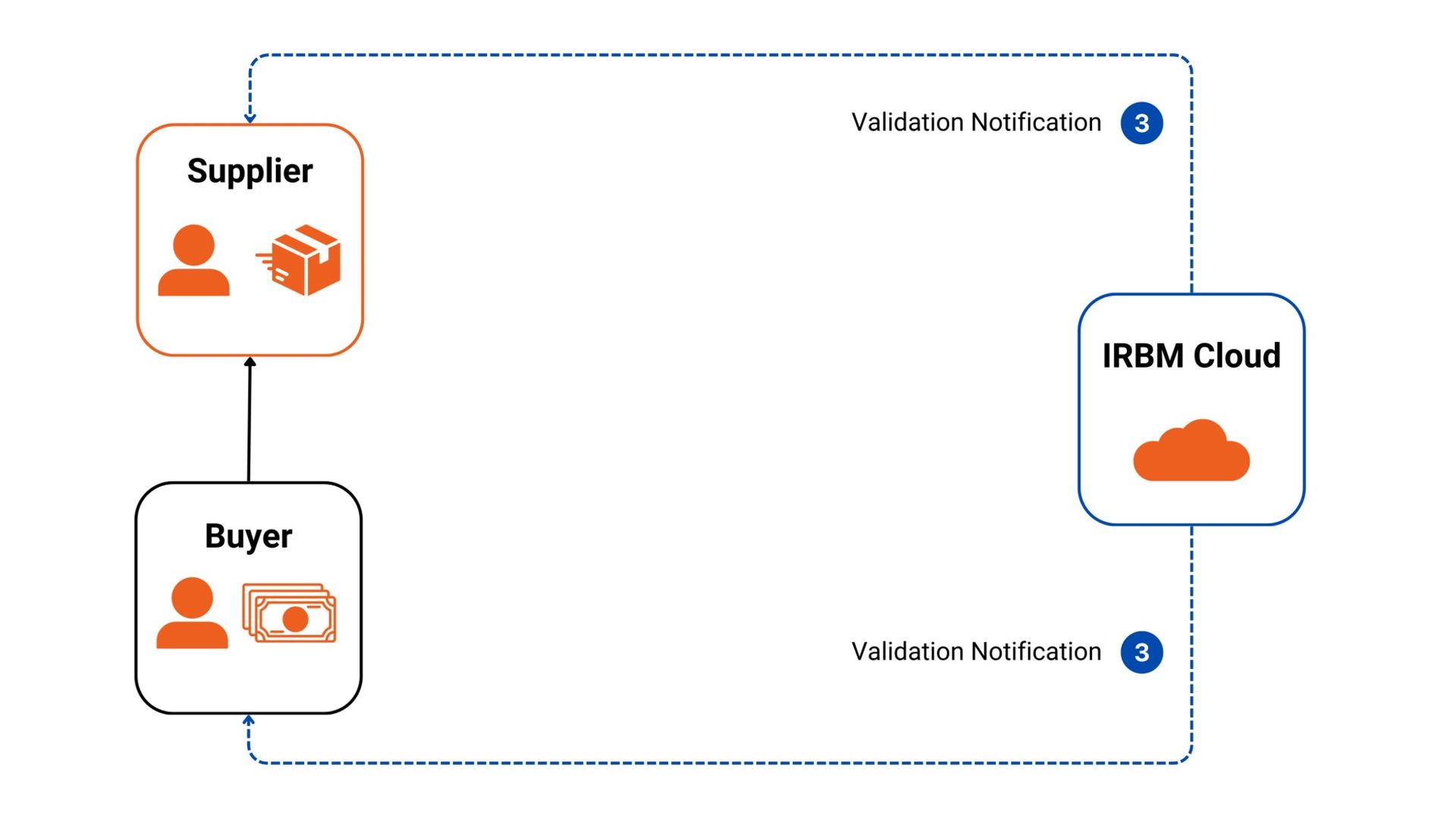

Step 3: Notification of validation

Once IRBM validates the e-invoice, a notification is sent to the relevant parties.

Buyer notification includes:

- UIN for the self billed e invoice.

- QR code for verification purposes. This code serves as proof that the transaction has been officially recognized.

Supplier notification includes:

- The supplier will receive a copy of the validated invoice via email or other preferred communication channels.

- For foreign entities, notification is optional if they do not have Malaysian-based communication access.

Step 4: Sharing of the validated self billed e invoice

After successful authentication, the buyer is responsible for distributing his self billed e invoice to the supplier. There are two different ways to do this:

- Electronic delivery: Share the e-invoice via email, supplier portals, or other mutually agreed digital platforms. The embedded QR code allows instant verification of the invoice’s legitimacy.

- Physical copy (if required): Although sharing in electronic format is the standard, some suppliers may request a printed copy to add to their business records. The printed invoice must still include all key elements, especially the QR code and UIN.

Step 5: Request and retrieval of self billed e invoice

The buyer can retrieve his validated self billed e invoice for his records, future reference, or audit purposes.

- Access via MyInvois portal: Log in to the portal to download the authenticated self billed e invoice, with embedded QR codes. Don't forget to store the invoice in a secure digital repository for compliance.

- Audit-ready filing: Keep a chronological record of all authenticated self billed e invoices. Organize files in a familiar and understandable logic to facilitate quick retrieval during an audit or upon request.

5 Expert Key Notes for Your Successful Self Billed e Invoice Journey

Navigating the complexities of creating and operating a self billed e invoice requires a deep understanding of regulatory requirements, system accuracy, and strategic organization. The five principles suggested by our e-invoicing team of experts will help strengthen your e-invoicing process.

Precision in data management

Accurate data is the foundation of the self billed e invoice journey. Meticulously validate transaction records, focusing on supplier and buyer tax codes, invoice amounts, tax codes, and descriptions. Use pre-structured templates, aligned with IRBM guidelines, to eliminate inconsistencies and prevent delays in validation.

Integration of technology systems

Integrate sophisticated software to enhance the e-invoicing experience. Implement ERP like Odoo with Odoo Invoice or accounting tools with seamless API compatibility to integrate with IRBM’s MyInvois portal. Automating the flow of data between systems reduces manual intervention, ensures data integrity, and speeds up processing.

Compliance with submission deadlines

Timeliness determines compliance. It is also important to avoid dangerous issues such as not processing invoices in time, not meeting agreed-upon deadlines with partners, or delays in purchasing and auditing.

Synchronize self billed e invoice submissions with payment dates or invoice receipts from overseas suppliers for imported services, adhering to the first occurrence timeline.

Organized record retention

Comprehensive record retention safeguards your business during audits. Store authenticated e-invoices, complete with QR codes and unique identifiers, in a secure and easily accessible format. Use a cloud-based repository for scalability and ensure proper categorization for efficient retrieval when needed.

Mastery of exemptions and special scenarios

Understanding exemptions for self billed e invoice is vital. Situations such as foreign employee expenses or specific dividend distributions need to be handled separately. Equip your team with knowledge of these cases and maintain robust training documentation, such as foreign invoices or receipts, to support transactions.

Final Thoughts

The self billed e invoice is an indispensable part of the process of developing and bringing e-invoicing into the official process in Malaysia. Of course, understanding it and making it a habit in the process of applying self billed e invoice will be a prerequisite for you to optimize your time and effort on e-invoicing and not panic before many detailed notes to adapt to IRBM regulations.

Don’t forget to contact us if you want custom consultation about e-invoicing implementation in Malaysia. Our e-invoicing experts are always ready to help you!