Introduction

Welcome to the exciting world of e-invoicing! As businesses in Malaysia are embracing e-invoicing as a matter of course in the digital landscape, it is time to acknowledge that e-invoicing is no longer a convenience - it has become a vital part for modern financial management. The e-invoicing market size is projected to increase by $26.13 billion at a CAGR of 27.34% to 2028 (according to technavio Plus).

It has become a necessary component for businesses of all sizes. From streamlining financial workflows to enhancing compliance, e-invoicing has played a significant role in revolutionizing the way businesses invoice. It’s clear that this shift is here to stay with ongoing advancements in technology. But what should you do with e-invoicing at this time so as not to miss all the useful trends?

To answer this question, buckle up and join us as we explore the transformative e-invoicing trends in Malaysia, as well as its statistics updated until now and our expert tips and tricks when implementing e-invoicing.

Top 6 E-Invoicing Trends in Malaysia for 2024: Key Insights

#1 AI and Machine Learning

AI and Machine Learning are among the most anticipated e-invoicing trends in Malaysia in 2024. It significantly improves e-invoicing by automating the extraction and validation of invoice data. For example, AI-powered systems can automatically capture key details such as amounts, dates, and match them with purchase orders. This significantly reduces the resources spent on data entry, manual validation, resulting in fewer errors and faster processing times.

Invoicing will thus be streamlined, with an emphasis on time savings and reduced administrative costs. According to Inside Big Data, some fintech companies claim to have reduced invoice processing time from around 25 days to just 3-5 days.

#2 Integration with ERP System

Integrating e-invoicing with your ERP system is one of the e-invoicing trends that is definitely worth considering, especially if your business is already well-established with the current module.

When seamlessly synced with ERP platforms, invoices match up automatically with purchase orders and receipts. This means no more manual data reconciliation and fewer glitches.

It’s the equivalent of having a well-oiled machine that keeps your financial records in perfect harmony. Say hello to smooth sailing and wave goodbye to the paperwork jungle!

#3 Increased Automation

As a popular e-invoicing trend, automation is taking e-invoicing to the next level by automating repetitive tasks. Automated systems can generate invoices, schedule approvals, and automatically pay. This level of automation not only speeds up the invoicing process, but also reduces the risk of errors, speeds up the payment cycle, and ensures that every invoice is processed efficiently and on time.

In a B2BE survey, 71% of respondents thought automation would be an e-invoicing trend with huge growth potential.

With automation in the driver’s seat, you can keep your operations cruising along without breaking a sweat.

#4 Enhanced Security with Blockchain

Blockchain is adding a new layer of security to e-invoicing. It enhances the security and transparency of e-invoicing Malaysia more than ever, as one of valuable e-invoicing trends. Every e-invoicing transaction, when using blockchain, is recorded on a secure and unchangeable ledger. This means that once an invoice is entered, it cannot be altered without leaving a trace.

This layer of security helps prevent fraud and ensures that every transaction is transparent and verifiable. You can rest easy knowing your invoicing process is locked down tighter than a drum. With this technology, it’s all about securing your financial fortress.

#5 Real-time Insights

Real-time insights, as one of the important e-invoicing trends in Malaysia for 2024, become a must-have for effective financial management. Modern e-invoicing solutions should provide dashboards and analytics that provide immediate visibility into invoice statuses, payment schedules, and cash flow.

This means you can monitor and manage your invoicing process in real-time, quickly resolving any issues that arise. With real-time data at your fingertips, making informed decisions and optimizing your financial operations becomes much easier based on current information.

#6 Tailored Invoicing Experiences

Personalisation is sure to be one of the e-invoicing trends worth looking out for in Malaysia in 2024. Recent studies show that 90% of customers value personalized e-invoicing experiences, and this trend is now having a significant impact on e-invoicing activities.

The ability to customize e-invoices can enhance your brand visibility and create a more professional impression, helping to build stronger relationships with customers.

By providing well-designed and personalized invoices, Malaysian businesses clearly demonstrate their commitment to customer satisfaction, as well as foster better client engagement.

Key E-Invoicing Trend Statistics: Updated in 2024

To understand the specific impact that e-invoicing trends have had on corporate finance, we took the time to research and collect key statistics (some from highradius) to give you a more specific picture. Read below for more insights:

Higher E-invoicing Adoption in Asia Pacific

The adoption rate of e-invoicing in Asia Pacific countries is much higher than in Europe and North America. Countries such as Malaysia, India, and China are leading the way. They are driven by clear government initiatives and regulations to streamline operations in financial processes, including e-invoicing. This trend reflects the region's commitment to the need for modernization and digital innovation.

More specifically, before you consider adopting e-invoicing trends in Malaysia, make sure you understand the mandatory e-invoices regulation from August 2024 for taxpayers with annual turnover above MR100 million, and this mandatory regulation will apply to all businesses from July 2025.

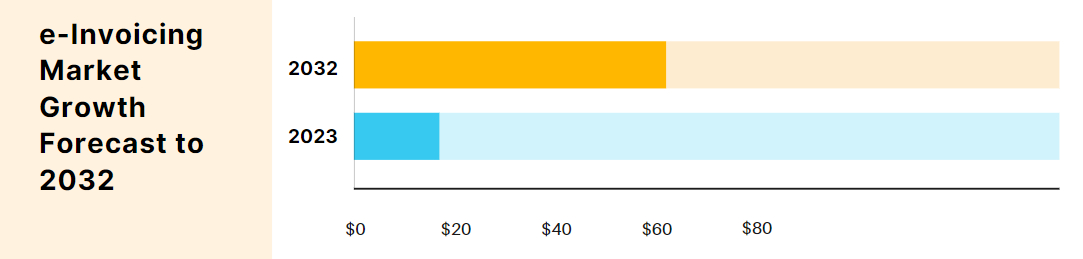

$61 Billion Projected Market Size in 2032

By 2032, the e-invoicing market is expected to reach around $61 billion, representing a significant increase from its 2023 valuation of $13.5 billion. This growth demonstrates the widespread adoption and integration of e-invoicing solutions across various industries. At the same time, it also confirms that the shift to e-invoicing is increasingly driven by high efficiency, good regulatory compliance, and improved financial transparency.

18% Market Growth Projected Over the Next Decade

The e-invoicing market is expected to grow at a CAGR of 18% over the next 10 years. This growth of e-invoicing trends is driven by the shift to digital transformation, increased regulatory requirements, and a push for more sustainable business practices. This is no surprise, as businesses increasingly want to make everything less paper and apply digitalization for all.

17.7% CAGR Growth in E-Invoicing Market

The global e-invoicing market is expected to grow at a compound annual growth rate (CAGR) of 17.7% from 2024 to 2032. This rapid growth reflects the strong move toward digital e-invoices (we can also call it e-invoicing trends). This process aims to streamline financial processes and reduce redundant costs such as printing or human resources.

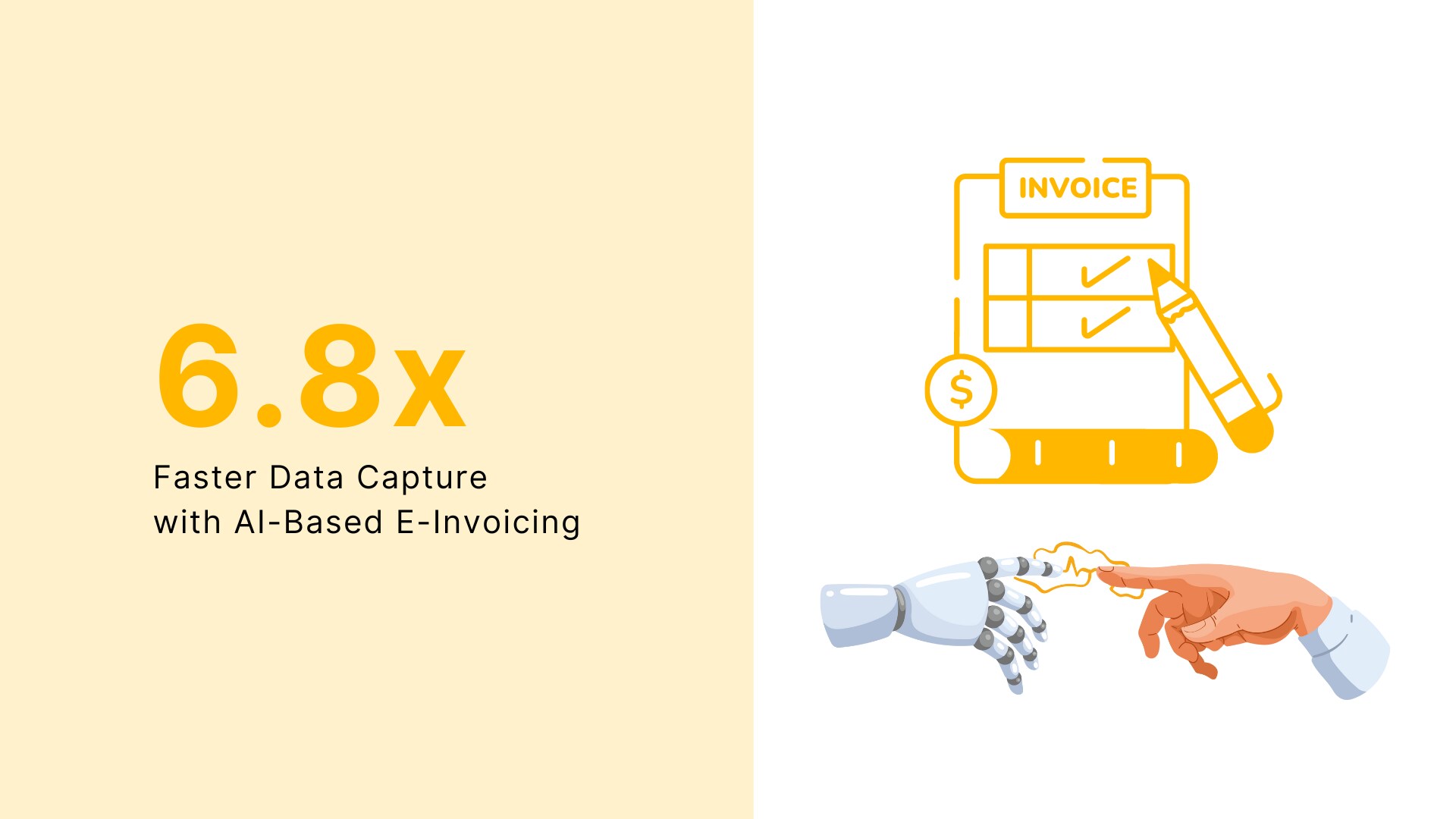

6.8x Faster Data Capture with AI-Based E-Invoicing

E-invoicing trends made by data solutions enable data capture and processing up to 6.8x faster than traditional manual methods. AI algorithms automatically extract data from invoices, helping to speed up the invoicing cycle and improve accuracy. Whether the volume of invoices is large or small, businesses no longer have to worry too much about how to process them efficiently.

74% of Business Experience Fewer Late Payments with E-Invoicing

Businesses using e-invoicing report a 74% reduction in late payments. The digital nature of e-invoicing ensures that invoices are sent immediately and can be tracked in real-time. Automated reminders and streamlined approval processes help speed up payments, improve cash flow, and reduce financial stress in building internal and external relationships.

70% of Professionals Report Increased Productivity with E-Invoicing

Research shows that 70% of professionals experience a significant increase in productivity when using an e-invoicing system. Automating the process of creating and managing invoices reduces manual data entry, speeds up processing times, and reduces errors. This increased efficiency allows your employees to focus on more strategic tasks, improving overall business performance.

You should also read this article: How Does E-Invoicing Work in Malaysia: A Comprehensive Guide

Our Tips and Tricks to Make Your E-Invoicing Journey Successful

Navigating the changing landscape of e-invoicing trends requires strategic planning and execution, not just starting from scratch. Our 5 best tips and tricks when implementing e-invoicing trends will help make your transition smooth and successful.

Invest in Training and Skill Development

Ensuring that your team is well-versed in the latest e-invoicing trends is critical to a successful transition. Invest in comprehensive training programs to equip your employees with the skills they need to effectively use new e-invoicing systems and tools.

This includes understanding how to handle AI-driven features, manage automated processes, and use real-time insights.

By providing your internal team with the knowledge and skills, you will ensure a smoother adoption and improved overall efficiency. Training helps reduce errors and increase confidence, making the transition to advanced e-invoicing practices more seamless.

Choosing The Right Technology Partners

Choosing the right technology partner is key to integrating e-invoicing trends solutions that align with your business needs. Look for providers that offer robust and scalable e-invoicing platforms with features that support automation, security, and ERP integration.

Evaluate potential candidates based on their track record, customer support capabilities, and the flexibility of their e-invoicing solutions.

Partnering with trusted and experienced technology providers will provide valuable support in terms of resources and time throughout your e-invoicing journey.

Customize and Optimize Your Invoicing Process

Customize your e-invoicing process to fit your business. Start by mapping your current e-invoicing process, identifying areas where automation and integration are possible.

Customize your e-invoicing system to automate routine e-invoicing trends such as invoice creation, approval workflows, and payment processing. Regularly review and optimize your process based on performance data and feedback.

This approach ensures that your invoicing system aligns with your business needs, eliminating bottlenecks, streamlining operations, and improving overall productivity.

Implement Robust Security Measures

Security is paramount when handling sensitive invoicing data. Implement robust security measures, including using encryption to protect data in transit and at rest, and use secure authentication methods to prevent unauthorized access.

As you embrace e-invoicing trends, update your systems regularly to address any security vulnerabilities and comply with industry standards. By prioritizing security, you can protect your business’s financial information and build trust with your customers.

Monitor and Evaluate Performance Regularly

Don’t stop at the initial launch. Continuously monitor and evaluate your system’s performance. Use analytics and reporting tools to track key metrics such as invoice processing time, error rates, and payment cycles.

Review these metrics regularly to identify trends, spot issues early, and make informed decisions about potential improvements. You have the ability to make the necessary adjustments to optimize your e-invoicing process and achieve better results. Continuous evaluation helps to maintain efficiency and drive ongoing improvements.

Final Thoughts

Understanding and successfully implementing e-invoicing trends into your invoicing system is a big challenge, especially when you are just taking the first steps into e-invoicing. However, they will be the key points for you to optimize the process of creating and controlling e-invoices for your business.

Grasping trends intelligently is never redundant, and that is also the way you create priorities for your business.

If you want to find a reputable e-invoicing solutions provider to receive more specific consultation, A1 Consulting is a strong candidate. Don’t hesitate to contact us immediately if you have any questions or issues about e-invoicing trends!