It’s a fun way to start this guide with a real-life example, right?

You’re a tech company owner in Malaysia, and you’ve just signed a big deal with a client in Germany. The first thing that’s bugging you is not the manpower or the supply, but the e-invoicing regulations with their various formats, currencies, and regulations. Malaysia is on track to make e-invoicing mandatory for all businesses by July 2025.

Believe us, it’s easier than ever, and you can get rid of your headaches with PEPPOL e-invoicing. No need to worry about cross-border compliance or payment delays. You get an automated, streamlined process that connects with global businesses and smoothens transactions.

Does this magic really work? Read this article below for more details.

Overview about PEPPOL e-Invoicing: Comprehensive Notes For You

Definition: What is PEPPOL e-Invoicing?

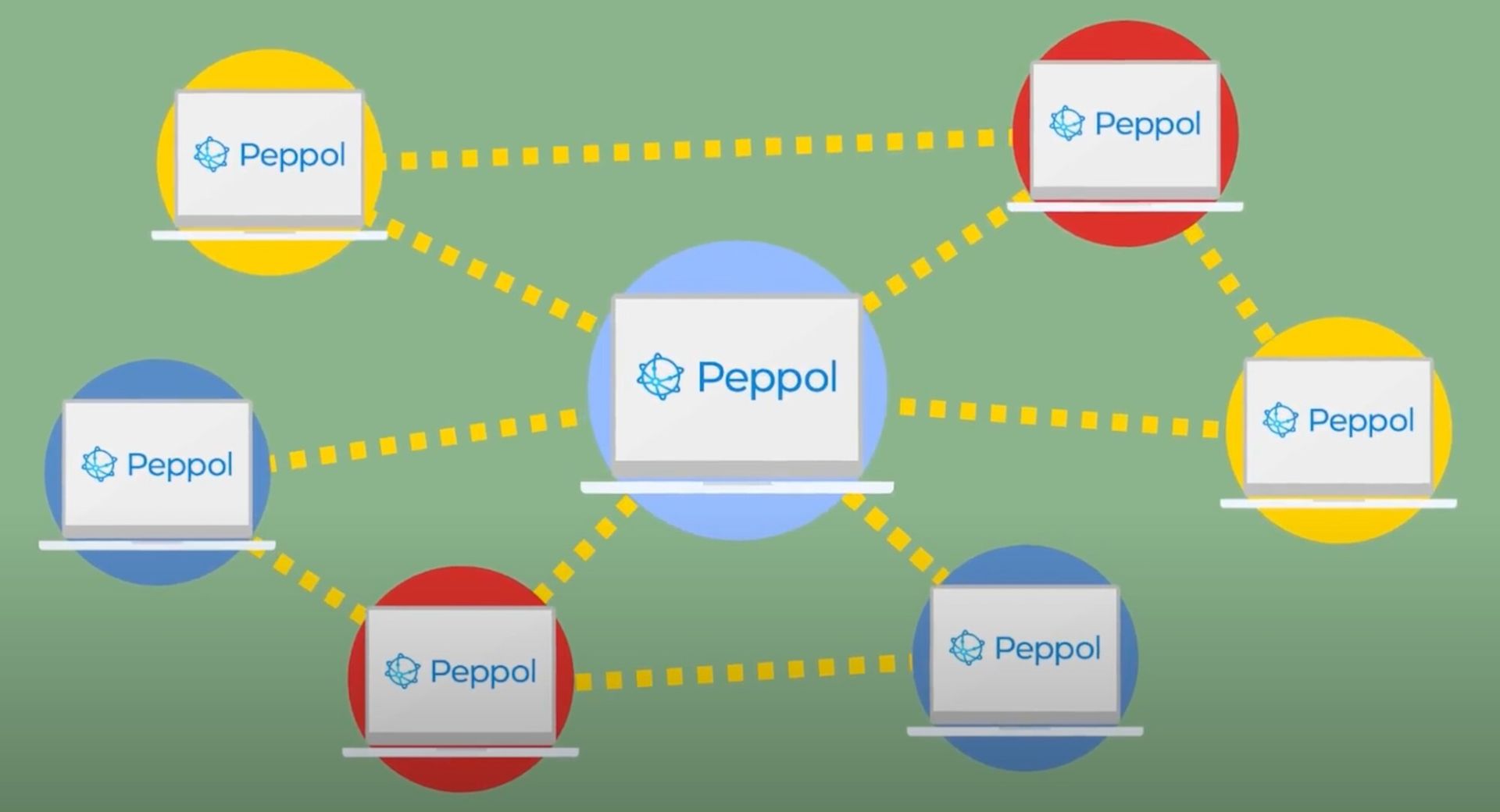

PEPPOL e-invoicing is a secure, standardized network designed to streamline the exchange of electronic documents across borders. It was originally developed as a European Union standard, allowing businesses to easily send invoices, purchase orders, shipping documents, etc. to any registered entity within the network.

The network quickly expanded beyond Europe, with multinational companies in countries such as Singapore, New Zealand, and the United States adopting it. It has gradually become a globally recognized standard.

PEPPOL can be affirmed as a powerful tool for businesses to confidently use e-invoicing when engaging in international trade. You will no longer have to worry about different e-invoicing formats or compliance issues between countries. PEPPOL’s standardized system ensures that your documents are secure, accurate, and compatible across borders. This paves the way for smoother and more efficient transactions.

Key Components of The Network

To get the most out of PEPPOL e-invoicing, you need to understand the key components that make up the network’s optimization and efficiency. Each component of the PEPPOL infrastructure works together to ensure your e-invoicing is sent securely and complies with global standards.

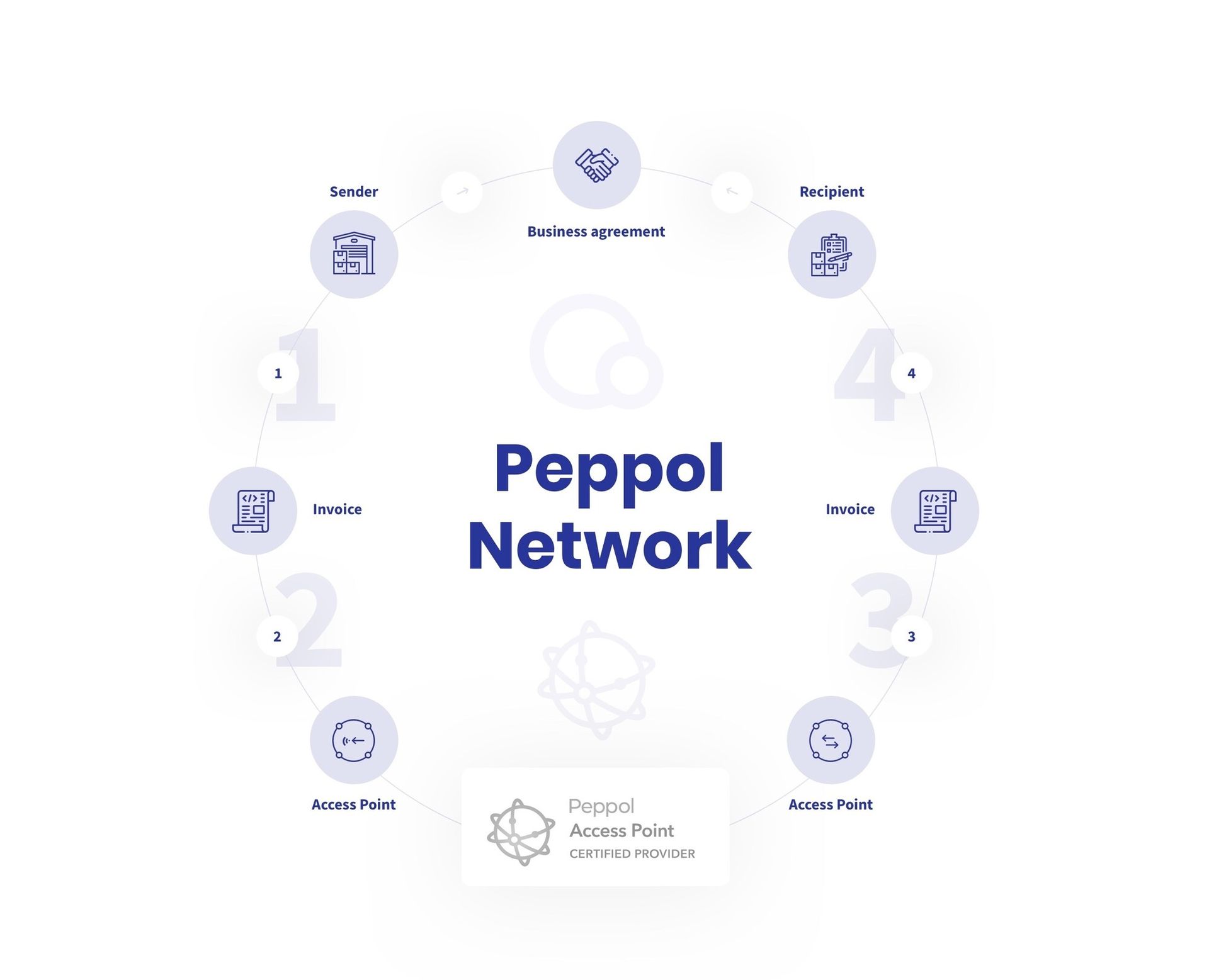

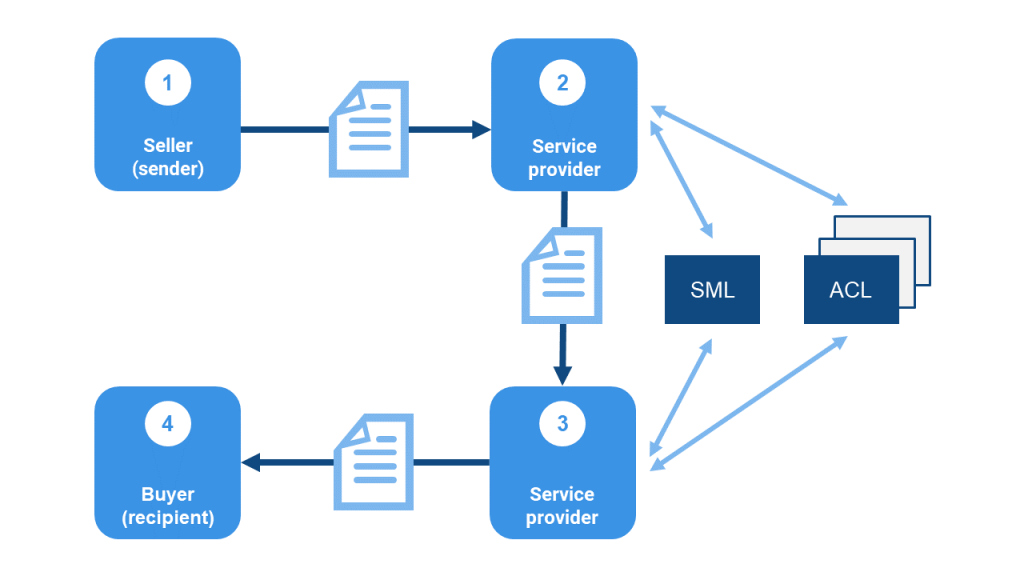

- 4-Corner Model: This model is the core of PEPPOL e-invoicing, allowing your business to connect with every entity in the network. It uses Access Points to connect different providers, ensuring seamless communication between all participants.

- Service Metadata Publisher (SMP): SMP acts as an online directory, listing the electronic addresses and document types that each business in the PEPPOL e-invoicing network can receive. When you need to send e-invoices, SMP helps you find the correct recipient details, ensuring that invoices are sent accurately and in the right format. It’s like having a precise map that guides your invoices straight to their destination.

- Service Metadata Locator (SML): SML is a centralized system that tracks the location of each SMP in the PEPPOL e-invoicing network. It will quickly find the correct SMP during the e-invoice sending process, ensuring your e-invoicing is delivered to the recipient without delay, maintaining efficiency, and increasing reliability.

- Business Interoperability Specifications (BIS): BIS includes rules that standardize how documents such as e-invoicing are formatted and exchanged within the PEPPOL network. They ensure that all e-invoices, regardless of where they are sent or received from, follow a consistent structure, making it easier for businesses to process and authenticate documents. BIS compliance helps you have invoices that meet international standards, reduce the risk of errors, and simplify cross-border compliance.

Comprehensive Process of How PEPPOL Works

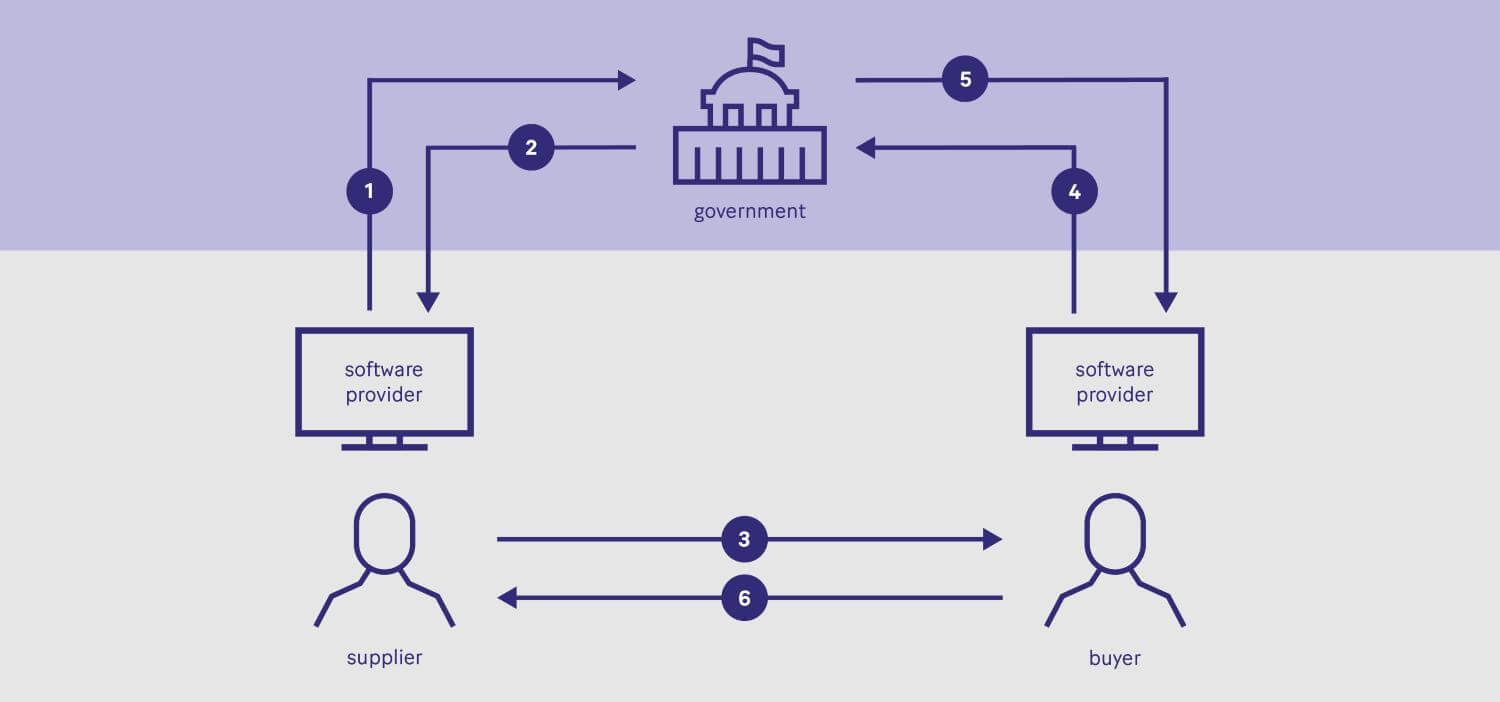

Here is a step-by-step guide on how PEPPOL e-invoicing works:

- Step 1: Preparation of the Invoice: The process starts with creating e-invoices that meet the PEPPOL Business Interoperability Specifications (BIS). It includes all the necessary details such as invoice number, date, and transaction details, formatted correctly for seamless processing.

- Step 2: Submission through Access Point: Once your e-invoices are prepared, you need to submit them through the PEPPOL Access Point. It acts as your gateway to the PEPPOL network, ensuring your invoice is transmitted correctly. It’s like a digital post office that handles the secure sending and receiving of your e-invoices.

- Step 3: Routing and Metadata Lookup: Once submitted, your e-invoices are routed through the network. The Service Metadata Locator (SML) plays an important role by redirecting your e-invoices to the correct Service Metadata Publisher (SMP), which stores the recipient’s electronic address and details.

- Step 4: Recipient Access Point: The recipient’s Access Point will receive your e-invoices and verify them against the specifications outlined in PEPPOL BIS. The Access Point will check the format and content for compliance before sending them to the recipient’s system.

- Step 5: Receipt and Processing: Once the e-invoices are received, the recipient’s system will process them based on their internal workflow. If all the necessary criteria are met, this e-invoice will be integrated into their payables system. The seamless integration reduces manual data entry and speeds up processing times.

- Step 6: Confirmation and Feedback: After processing, the recipient's system can send a confirmation back via the PEPPOL network to confirm receipt and acceptance of the invoice. This feedback loop ensures that both parties are aware of the invoice status, avoiding any confusion or disputes.

About PEPPOL Access Point

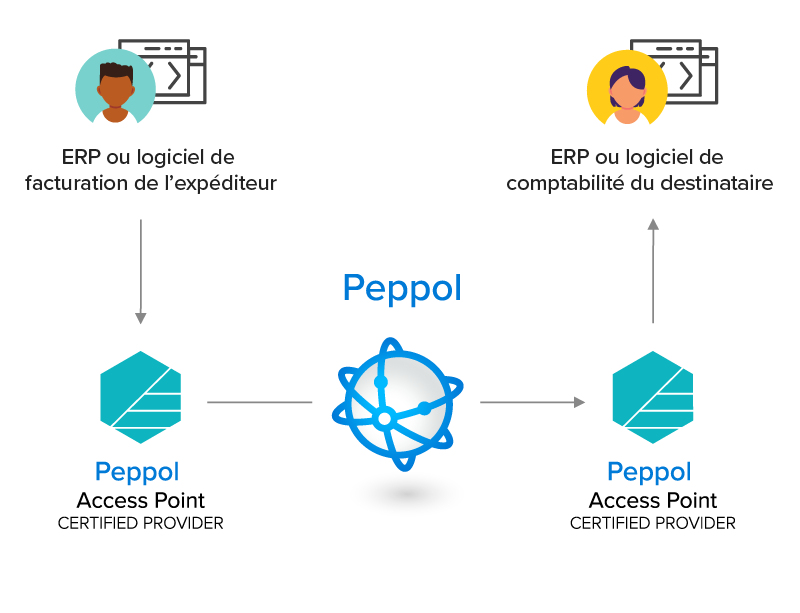

Basically, a PEPPOL Access Point is your business gateway to the PEPPOL network, allowing you to send and receive electronic documents seamlessly and securely. It acts to ensure that your business documents are sent accurately and securely as they are processed from the point of transfer to the recipient's documents and systems.

The process follows the PEPPOL e-invoicing 4-corner model. In this model, your business and the recipient's business each have their own Access Points, creating a clear and efficient path for exchanging documents. The Access Points manage the formatting and delivery according to PEPPOL standards, ensuring that your invoices are processed correctly.

A note regarding setting up a PEPPOL Access Point: it involves a detailed process that includes registration with the local PEPPOL authority or OpenPeppol, accreditation and ongoing maintenance. This is considered a complex and resource-intensive task, so many small businesses tend to use Access Points from certified 3rd party providers. It makes the operations simpler, easier, and more cost-effective than ever.

With over 300 certified Access Points globally, you have the flexibility to choose a provider that meets your specific needs.

About PEPPOL Authority

To seamlessly integrate PEPPOL e-invoicing into your business processes, it is extremely important to understand PEPPOL Authority. Currently, there are 17 official PEPPOL Authorities, each overseeing compliance with these standards in their respective regions.

PEPPOL Authority plays a dual role.

- Certify that Access Points meet the technical and operational standards mandated by the PEPPOL network. It ensures that your e-invoices and other electronic documents are processed efficiently and accurately across the network.

- Have the authority to impose country-specific requirements on the design and content of PEPPOL documents. Ensure that standards are tailored to local regulations and business practices, enhance compliance, and ensure appropriateness across different regions.

Additionally, all PEPPOL Authorities are required to report to OpenPEPPOL, an international non-profit organization responsible for developing and disseminating the PEPPOL standard globally. OpenPEPPOL sets common guidelines and standards for the network, while national authorities implement these standards locally. This structure ensures a consistent and high-quality e-invoice creation experience, no matter where your business operates.

You should also read this article: How Does E-Invoicing Work in Malaysia? A Comprehensive Guide

Why Malaysia Choose to Integrate with PEPPOL e-Invoicing?

There are many reasons why PEPPOL e-invoicing is Malaysia’s choice for e-invoicing for all businesses.

Network Security

When using PEPPOL e-invoicing, your documents are protected by a robust security framework. PEPPOL uses encryption, digital signatures, and secure protocols to protect your data, ensuring it is unalterable and maintaining privacy.

These security measures are essential to protect sensitive financial information and prevent unauthorized access, which is especially important for maintaining tax compliance and protecting against cyber threats.

Cost Efficiency and Savings

Using PEPPOL e-invoicing can significantly reduce your operating costs. Studies have shown that the cost of processing traditional paper invoices can range from €2.50 to €15 per one, while e-invoicing processed through PEPPOL is significantly cheaper, often under €5.

This comes from eliminating traditional paper, printing, mailing, and manual data entry time, resulting in more efficient processing and faster payments.

Compliance with International Standards

PEPPOL Authorities ensure that your e-invoicing activities comply with European regulations. By adhering to PEPPOL guidelines, your business not only clearly meets current mandatory regulations, but is also well-positioned to adapt to future changes.

Facilitating Global Trade

One of the key advantages of PEPPOL is its ability to simplify global trade. With the 4-corner model, your business can easily connect to any company in the network, regardless of where they are located. This global connectivity means you can expand your market reach without having to adapt to too many international e-procurement systems, making business transactions smoother and more accessible.

Environmental Impact

PEPPOL e-invoicing is also a step towards sustainable business practices. By reducing the reliance on paper and physical storage, PEPPOL e-invoicing contributes to lower energy consumption and waste. This not only cuts operating costs but also aligns with overall environmental goals, demonstrating a business’s commitment to reducing its ecological footprint.

Really Should Use PEPPOL e-Invoicing if You’re …

Some businesses in Malaysia will benefit in particular from adopting PEPPOL e-invoicing. Why and how? Check it out with our expertise listed below and guess if you are one of them.

Small Businesses Aiming for Global Reach

For small businesses, PEPPOL e-invoicing not only provides exceptional data security but also expands access to international markets. The network connects trading partners worldwide, eliminating the need to build a complex e-procurement system.

With PEPPOL e-invoicing, small businesses can partner with any public sector organization or private company on the network, leveling the playing field and opening up new opportunities for global trade.

Government Bodies

If you are a government office, adopting PEPPOL e-invoicing is essential to maintain compliance, transparency, and security. It is compliant with all regional regulations, helps prevent tax fraud, and increases the transparency of the legal system.

It also automates document processing, reducing manual errors and the environmental impact associated with paper invoices. By adopting PEPPOL, government agencies can take the lead in modernizing document exchange operations across their regions.

Buyers Managing Multiple Suppliers

Private companies with large supplier networks will greatly benefit from the standardization capabilities of PEPPOL e-invoicing. Managing invoices and purchase orders from multiple suppliers can certainly be a challenge, but PEPPOL streamlines these processes directly from ERP systems.

The network increases interoperability, improves data quality, and standardizes document exchange, making procurement more efficient and less error-prone.

Suppliers Handling Multiple Buyers

If you need to send e-invoices to multiple buyers, PEPPOL e-invoicing can simplify your operations. Instead of managing multiple portals for each buyer, PEPPOL allows you to use one and only one system to exchange documents across your supply chain and with government agencies.

This network not only reduces administrative burdens but also provides real-time status updates, helping you ensure that your e-invoices are being received and processed efficiently.

Public Sector Firms Seeking Efficiency

Organizations in the public sector should strongly consider PEPPOL e-invoicing due to EU Directive 2014/55/EU. PEPPOL simplifies the invoicing process for public procurement by promoting the use of standardized e-invoicing. The system ensures that public sector companies meet specific requirements for the format, content, and delivery of e-invoicing, streamlining operations and promoting more efficient procurement processes.

Companies Focused on Sustainability

Businesses that prioritize sustainability will be delighted to use PEPPOL e-invoicing because of its environmental benefits. E-invoicing through PEPPOL eliminates the need for paper, reduces energy consumption, and minimizes the need for physical storage space. By adopting PEPPOL, companies can contribute to environmental conservation while saving costs and streamlining operations.

Our Expert Tips when Using PEPPOL e-Invoicing

Switching to PEPPOL e-invoicing can significantly streamline your invoicing process, but to maximize its benefits, there are a few key strategies to keep in mind.

Customize Your E-Invoice Templates for Compliance

One of the key advantages of PEPPOL e-invoicing is its ability to ensure compliance with regional and international standards. To take full advantage of this, customize your e-invoices to meet the specific requirements of each country in which you do business. This includes adjusting formatting, tax codes, and legal disclaimers to match local regulations.

That way, you minimize the risk of non-compliance, reduce manual intervention, and ensure invoices are processed smoothly across borders.

Monitor Invoice Statuses for Better Cash Flow Management

PEPPOL e-invoicing’s real-time status updates provide valuable insight into the stages of your e-invoices’ processing. Use this feature to proactively monitor the status of your invoices – whether they’ve been sent, received, approved, or paid.

By closely monitoring these updates, you can quickly address any delays or issues that arise, ensuring a steady cash flow and minimizing the likelihood of late payments. This proactive approach helps maintain strong relationships with your trading partners and facilitates better financial planning.

Partner with a Reliable PEPPOL Service Provider

While PEPPOL e-invoicing offers many benefits, there’s no denying that its navigation process can be overwhelming for beginners. To enhance your experience, consider partnering with providers who have extensive experience working with PEPPOL e-invoicing.

They have expertise in integrating PEPPOL with ERP systems, ensuring seamless document exchange and compliance with all necessary standards. In addition, they will ensure ongoing support, keeping you up to date with any changes to PEPPOL regulations or standards. This partnership will not only simplify your e-invoicing journey, but also ensure that you take full advantage of the capabilities of the PEPPOL network.

Final Thoughts

Integrating PEPPOL e-invoicing into your business is not only about meeting current regulations, but also about increasing efficiency, enhancing security, and staying competitive in the digital landscape. By understanding PEPPOL e-invoicing in-depth and following our expert tips and tricks, you will be able to streamline your invoicing process, improve your cash flow, and keep your business running smoothly.

And don’t worry if you have any questions about e-invoicing implementation in Malaysia, we at A1 Consulting are always here to help. Don’t hesitate to contact us to have a custom consultation with our e-invoicing experts!